General information

The most profitable free economic zone in the UAE

Advantages

- The personal presence of the owner is not required

- Lack of authorized capital

- 100% property of the founder

- Simple and clear registration procedure

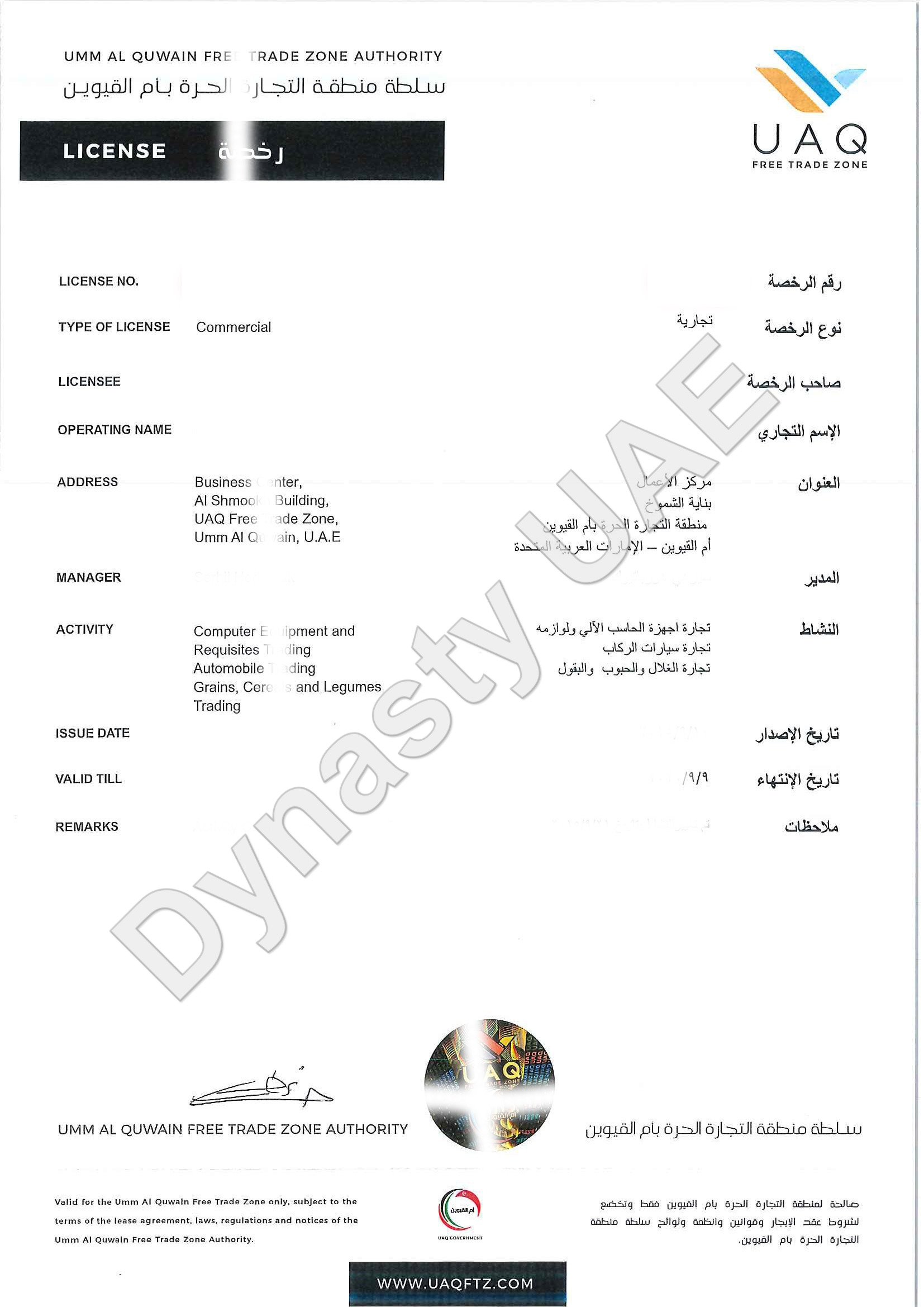

- Wide range of permitted activities

- Company registration in 1-2 days

Flaws

- A UAE visit stamp is required (provided you are applying for a resident visa)

- The official address of the company will be Umm Al Quwain

Commercial and general commercial license

Commercial licenses give you the right to import and export products to and from the UAE. You can import your products and sell them to other companies in the UAE, who will be designated as your agents or distributors.

A standard commercial license can include up to 3 different product categories, for example: “Food”, “Cosmetics” and “Building Materials”.

A general commercial license gives you the right to import/export any category of goods without any restrictions.

Cost of a commercial license for the Umm Al Quwain FEZ

- Gives the right to open an onshore company for 3 trading activities or two consulting activities.

- Does not give the right to obtain a resident visa

- Includes license fee and virtual office

- Entitles you to 2 resident visas, including an owner (investor) visa

- Includes license and virtual office

- Entitles you to 3 resident visas. And also trade in all types of goods

Activities that can be registered in the Umm Al Quwain Free Zone

Cost of registration in Umm Al Quwain FEZ

|

Activity Type |

Visa |

Cost |

|---|---|---|

|

Trading / Service / E-commerce license + Flexi Desk |

– |

AED 19,800 $5,400 |

|

Trading / Service / E-commerce license + Flexi Desk |

1 visa |

AED 26,800 $7,330 |

|

Trading / Service / E-commerce license + Flexi Desk |

2 visas |

AED 38,400 $10,500 |

|

Activity Type |

Visa |

Cost |

|---|---|---|

|

General trading + Flexi Desk |

No visa |

AED 33,800 $9,250 |

|

General trading + Flexi Desk |

1 visa |

AED 40,800 $11,150 |

|

General trading + Flexi Desk |

2 visas |

AED 45,400 $12,410 |

|

General trading + Flexi Desk |

3 visas |

AED 50,000 $13,670 |

|

Activity Type |

Visa |

Cost |

|---|---|---|

|

Premium license + Flexi Desk |

No visa |

AED 38,800 $10,600 |

|

Premium license + Flexi Desk |

1 visa |

AED 45,800 $12,520 |

|

Premium license + Flexi Desk |

2 visas |

AED 50,420 $13,770 |

|

Premium license + Flexi Desk |

3 visas |

AED 55,035 $15,050 |

|

Activity Type |

Visa |

Cost |

|---|---|---|

|

Freelance license |

No visa |

AED 20,700 $5,652 |

|

Freelance license |

1 visa |

AED 25,000 $6,833 |

Documents needed for company registration:

DOCUMENTS PROCEDURE FOR INDIVIDUAL SHAREHOLDER

- Passport copy

- Visa or entry stamp copy

- Photo of the founder

- Utility bill

Terms of company registration

- 1 day – name confirmation

- 1 day – company registration

- 1-2 weeks – founding card

- 1 week – entry visa

- 1 day – medical tests and Emirates ID

- 2-5 days – visa insertion

Residence permit in the UAE

Investor visa and work visa

The number of visas you can open depends on the service package you choose. For example, if the type of company you choose allows you to open 2 visas, then you can open no more than 2 visas, including an owner visa and a work visa, for example: 1 investor visa + 1 work visa.

Cost and validity period

-

Investor visa

government visa fee + cost of medical examination and Emirates ID card. The visa is valid for 3 years. -

Work Visa

government visa fee + cost of medical examination and Emirates ID card. The visa is valid for 2 years.

Family visas

An investor visa or work visa gives you the right to open visas for your relatives – wife, children, or parents. To do this, you must provide documents confirming your relationship (marriage or birth certificate). They must be certified by the UAE embassy in your country. To obtain a family visa, you need to have an official rental agreement in the EJARI (government attestation) system. When opening a visa for parents, the apartment must have at least 2 bedrooms.

Cost and validity period

- Visas for relatives of investor/work visa holders:

government visa fee + cost of medical examination and Emirates ID card + refundable fee. The validity period of the visa is equal to the validity period of the sponsor visa.