The world is becoming increasingly digital, and cutting-edge technologies are gaining popularity. Among these, the decentralized payment system — cryptocurrency, which operates entirely autonomously — has attracted widespread interest and is rapidly being adopted by national economies. Naturally, the prosperous UAE quickly recognized the potential of the crypto industry and has taken an active role in supporting this trend. However, the regulation of electronic currency in the country is still in the development stage, which could be used by fraudsters. Therefore, experts at Dynasty Business Adviser suggest considering whether businesses operating in the Emirates should engage with cryptocurrency.

Development of crypto Dubai and the UAE

In 2020, the Central Bank issued regulations allowing the use of distributed ledger technology for the transfer, storage, or sale of electronic assets. Following this, some companies became more willing to accept cryptocurrency, with even restaurants allowing payments in cryptocurrency.

To regulate activities related to cryptocurrency transactions, the UAE government has taken the following steps:

- a regulatory framework has been introduced, requiring companies holding crypto assets to obtain the appropriate licensing;

- the AML policies have been developed to combat money laundering;

- in 2017, the Securities and Commodities Authority (SCA) issued a warning to investors in the UAE about the risks associated with investing in ICOs and other cryptocurrencies.

Legality of cryptocurrency for businesses

Despite the implemented norms and protective measures, the government emphasizes that currency buyers and investors should exercise extreme caution. Cryptocurrency is still not recognized as an official means of payment. One of its vulnerabilities is the anonymity of the payer. However, such a digital asset is considered reliable — it cannot be counterfeited in a way that allows unauthorized use of funds.

To avoid accidentally violating UAE laws, get fake currency punishment in UAE or risking investments in fraudulent projects, it is advisable to seek professional consultation. At the very least, to avoid coming under the scrutiny of the AML fiscal service, it is recommended to refrain from cryptocurrency transactions within the first six months after establishing a company.

Risks of exchanging and using cryptocurrency

Market volatility

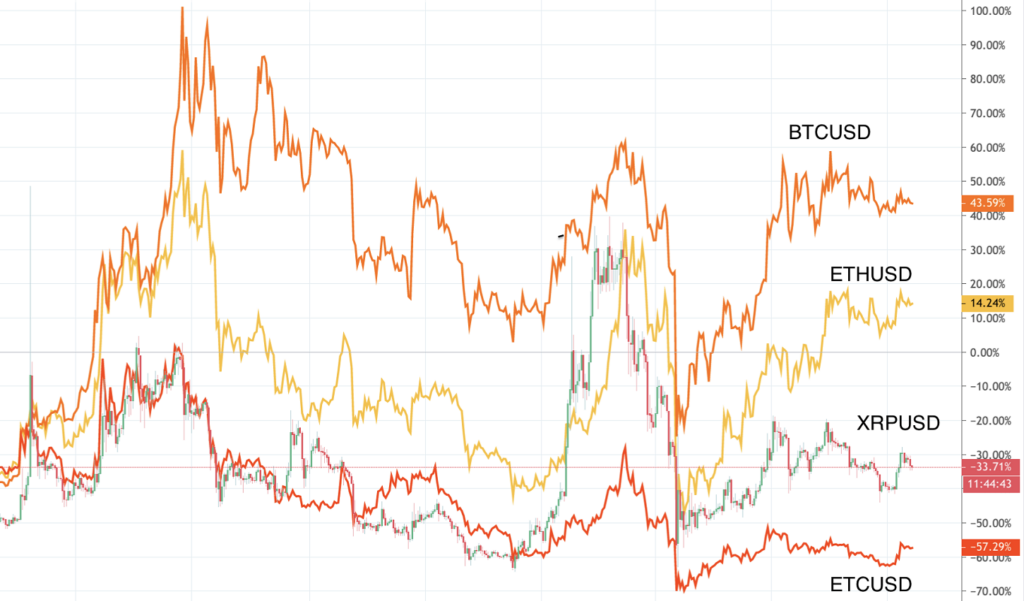

Cryptocurrency markets are known for their high volatility. The value of cryptocurrencies can fluctuate significantly within short periods, creating uncertainty for investors and users. Sharp price changes can lead to substantial financial losses, especially if major transactions, such as real estate purchases, are tied to cryptocurrency rates.

Cybersecurity threats

Cryptocurrencies are frequently targeted by hackers. Exchange breaches, personal data theft, and phishing attacks are just some of the threats. Scammers often use social engineering and various schemes to trick unsuspecting users into sharing confidential information. Losing funds due to a wallet breach can be irreversible, as blockchain transactions are final.

Unlike the banking sector, where the response to the question of how to get money back after being scammed online in UAE is straightforward: contact support and provide evidence. In such cases, the bank often blocks the suspicious account and passes the information to the relevant authorities.

Technical failures

Cryptocurrency networks and platforms rely on technology, which can sometimes fail. Issues with the blockchain, code errors, or infrastructure problems can cause payment delays or loss of funds, which is particularly critical in large transactions. Additionally, cryptocurrency wallet addresses consist of long strings of letters and numbers. Manually entering them can easily result in errors, sending funds to the wrong wallet or causing them to be lost “into the ether,” where they may be impossible to recover.

Cryptocurrency regulation in development

At present, the regulation of cryptocurrency in the country is still developing. The challenge lies in the fact that, due to the nature of blockchain technology, electronic money is nearly impossible to control, meaning it cannot be blocked or retrieved. Especially if the transfer was made through a private channel to an anonymous wallet.

If you’re wondering “what to do if cryptocurrency is stolen,” it’s essential that you engage with cryptocurrency exchanges licensed in the UAE. Such platforms can protect users from cryptocurrency fraud almost as effectively as banks, provided that wallets can be tracked and the claimant has indisputable evidence.

The government’s efforts to prevent financial crimes are still not consistently successful. The fraudulent schemes involving cryptocurrency continue to evolve alongside the technology’s spread.

Phishing and fraud

Cryptocurrency scams in Dubai and other Emirates — fraud schemes aimed at stealing funds from investors or cryptocurrency users — are not uncommon. There are various types of cryptocurrency scams, such as:

- Chargeback fraud. After purchasing cryptocurrency, scammers contact the bank to request a refund, pretending to be victims of fraud.

- Phishing. Scammers of cryptocurrency scams create fake websites or send fraudulent emails to steal users’ personal information, such as passwords or private keys. An example of phishing is fake exchanges that ask for personal information under the pretext of a “locked wallet”.

- Pump and Dump schemes. A group of people or organizations collude to artificially inflate the price of a specific cryptocurrency by spreading false or exaggerated news. When the price peaks, they sell their assets, crashing the market and leaving other investors with losses.

- Fake giveaways. Scammers conduct fake cryptocurrency giveaways, offering users a crypto “wallet verification” supposedly generating currency. For example, information is sent in private messages or posted on social media, promising to double the amount for a certain quantity of cryptocurrency.

- Fake platforms. What to do if you bought a scam token? Scammers may create fake platforms for selling NFTs, where they sell counterfeit tokens. These platforms may appear legitimate, but after purchasing tokens, users find out that the NFTs are worthless.

- Schemes involving illegal funds. Criminals offer to buy cryptocurrency with cash. As a result, the seller may become an unwitting accomplice to a crime.

Risk mitigation

To reduce the risks of using cryptocurrency, the following steps are typically helpful:

- Researching the subject and market. Avoid jumping at attractive offers; it’s essential to check token for scam before purchasing. This can be done by researching the team, platform, and artist who created the NFT. Ensuring the authenticity of the token is crucial.

- Security measures. Never share confidential information with anyone. Typically, neither banks, government agencies, nor cryptocurrency companies ask for personal data, passwords, or keys. Scammers are the ones attempting to extract such information.

- Tracking transactions. Keep a record of all transactions. This helps save time and ensures your correctness in case of disputes.

- Choosing reliable exchanges. Only reliable, legally operating cryptocurrency exchanges in the UAE can help protect your interests in case of disputes.

- Diversifying risks. Avoid investing in a single asset. Distributing funds across various wallets and exchanges can minimize losses in case of an attack by fraudsters or currency fluctuations.

Despite the risks, cryptocurrency offers numerous advantages, which is why it continues to gain popularity.

Advantages of using cryptocurrency

- Speed and efficiency. Transactions with digital currencies are usually processed faster than traditional bank transfers, which speeds up the process of purchasing real estate or other goods and services.

- Low fees. Cryptocurrency transfer fees are generally lower than bank fees, especially for international transactions.

- No taxes. As of August 2024, cryptocurrency in the UAE is not subject to taxation.

- Privacy. Using cryptocurrency ensures a high level of anonymity and privacy in transactions.

- Global accessibility. Digital currencies enable payments and transfers without geographical limitations. This is particularly beneficial for international investors and buyers.

How to choose a reliable cryptocurrency

If you use reputable platforms and diversify your assets, it’s not difficult to protect your business from risks. First, make sure that the cryptocurrency exchange is licensed and has the appropriate approvals from regulatory bodies. In Dubai, this is the Financial Service Regulatory Authority (DFSA), and in Abu Dhabi, it’s the Global Market (ADGM). You can check cryptocurrency exchanger through various methods:

- research information online and read reviews;

- ask for recommendations from acquaintances who use cryptocurrency;

- request the license directly from the service provider — this is considered standard practice in the UAE;

- seek professional assistance from experts.

It’s also important to choose a reliable currency, such as stablecoins (USDT, USDC). These are pegged to the US dollar, making them less susceptible to fluctuations.

Conclusion

The cryptocurrency market is rapidly evolving, as technology has become an integral part of our lives and is here to stay. Is it worth getting involved with cryptocurrency? To fully benefit from these innovations, it is important to monitor trends continuously. If understanding them is challenging or you lack the time to study the matter, it is better to seek professional help rather than risk losing your hard-earned money.

Our Company can provide consulting or other qualified assistance. Our services include:

- full-service company registration across the UAE;

- business licensing, including for cryptocurrency-related activities;

- preparation of internal company policies on AML;

- opening a corporate bank account, that is crypto-friendly;

- assistance with selecting reliable exchanges.

Contact us, and we will help you easily overcome technical barriers and significantly reduce the risks of doing business while using innovative technologies.