Advantages of registering a company in Internet City Free Zone

The attractiveness of the DIC FZ territory for opening companies involved in IT business here is explained by the numerous advantages provided by the FEZ authorities to foreign investors. The main ones are as follows:

- ideal conditions for business development – modern, 24-hour guarded offices and well-developed infrastructure;

- diverse business environment that provides unlimited opportunities for interaction;

- the opportunity for foreign founders to own and manage a company without involving a local partner, a UAE citizen;

- duty-free import and export of goods and services;

- lack of currency control and restrictions on the distribution of financial resources, the possibility of one hundred percent withdrawal of income and capital.

The Internet City Free Zone in Dubai has retail chains and hotels, provides modern and high-quality medical care, and provides world-class banking services.

Types of Companies in Dubai Internet City Free Zone

In the DIC free economic zone you can register a company of one of the following types:

- FZ-LLC is a limited liability company with a number of shareholders from 1 to 50. To open such a company, you need an authorized capital of 50,000 dirhams, and the money must be placed in a bank account;

- representative office of the UAE company;

- branch of a foreign company.

Opening branches of companies does not require the presence of authorized capital.

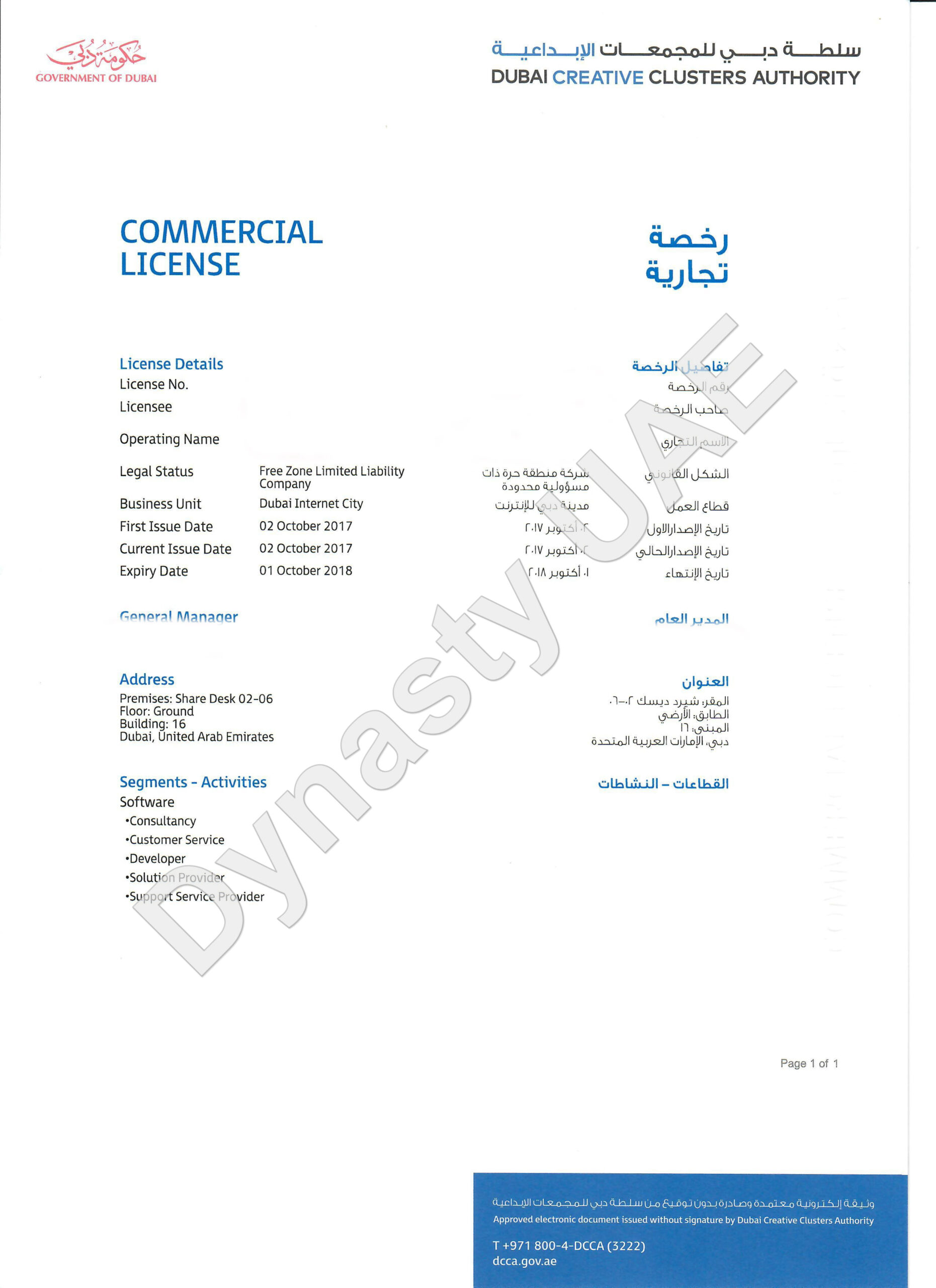

Types of activities that can be registered in the INTERNET CITY FREE ZONE

DUBAI INTERNET CITY – Activities

1. Software – activities related to the development, installation and/or modification of own or third-party software products:

- Consultations

(Companies that provide expert advice to other entities on the creation and optimization of business processes, technical and consulting research, market assessment and customer profiling, technical services and consulting on IT and applications such as Intranet, Internet and data warehouses to improve administration and Maintenance.) - Developer

(Companies that create and customize individual content, components, applications or programs for themselves or for third parties.) - Solution Provider

(Companies that resell, distribute or implement software for third parties. Services also include the provision of specific IT solutions for business entities, such as security or IT infrastructure, as well as customized, specialized services for clients over an extended period of time.) - Customer support

(Companies that provide after-sales support to improve or keep a software product up to date.) - Support

(Companies that provide individual services and products to third parties for the purpose of conducting or promoting other related activities.)

2. 2. Internet and multimedia – activities related to the development and/or distribution of Internet or multimedia content. Other activities may include distributing goods or services over the Internet, for example by providing an online platform and acting as an intermediary between several companies or several individuals. Additional activities may include providing various applications in the network.

- Consultations

(Companies that provide expert advice to other entities on the creation and optimization of business processes, technical and consulting research, market assessment and customer profiling, technical services and IT consulting, as well as applications such as Intranet, Internet and data warehouses to improve administration and maintenance.) - Developer

(Companies that create and customize individual content, components, applications or programs for themselves or for third parties.) - Solution Provider

(Companies that resell, distribute or market Internet and multimedia content, services or applications to third parties. The list of services also includes specific IT solutions for providing such content and services to third parties.) - Customer support

(Companies that provide after-sales support to improve or maintain the relevance of a product or service.) - Support

(Companies that provide certain services and products to third parties for the purpose of promoting other related activities. These include companies that:- Provide goods, services and carry out commercial transactions in electronic format. This includes companies that use closed information networks.

- Are connected to open information networks.

- Act as intermediaries to transfer products from sellers to customers directly through the network.

- Create portals between two or more objects, to which only these objects have access.

- Create a portal for businesses that only their clients have access to.

- Host websites on their servers, providing hosting and security.

3. Telecommunications and networks – activities related to the development, installation, modification and/or operation of networks, as well as the provision of related services for the operation of network applications or services. Manufacturing of physical components in the zone and direct trade of physical components and products in the UAE market is not permitted.

- Consultations

(Companies that provide expert advice to other entities on the creation and optimization of business processes, technical and consulting research, market assessment and customer profiling, technical services and consulting on IT and applications such as Intranet, Internet and data warehouses to improve administration and Maintenance.) - Developer

(Companies that create/configure/modify and/or operate networks and provide related network application services for themselves or third parties.) - Solution Provider

(Companies that resell, distribute or implement software for third parties. Services also include the provision of specific IT solutions for business entities, such as security or IT infrastructure, as well as customized, specialized services for clients over an extended period of time.) - Customer support

(Companies that provide after-sales support to improve or keep a software product up to date.) - Support

(Companies that provide individual services and products to third parties for the purpose of conducting or promoting other related activities.)

4. IT services – activities related to the development and provision of standardized IT services, which may also include security solutions, localization, training and corporate education.

- Consultations

(Companies that provide expert advice to other entities on the creation and optimization of business processes, technical and consulting research, market assessment and customer profiling, technical services and consulting on IT and applications such as Intranet, Internet and data warehouses to improve administration and Maintenance.) - Developer

(Companies that create and customize discrete content and programs for themselves or third parties.) - Solution Provider

(Companies that resell, distribute or implement software for third parties. Services also include the provision of specific IT solutions for business entities, such as security or IT infrastructure, as well as customized, specialized services for clients over an extended period of time.) - Customer support

(Companies that provide after-sales support to improve or maintain the relevance of a product or service.) - Support

(Companies that provide individual services and products to third parties for the purpose of conducting or promoting related activities.)

Types of licenses in Internet City Free Zone (Dubai)

To be able to operate in the DIC SEZ, companies must purchase the required type of license:

- software license – it allows you to develop, upgrade and install software;

- a telecommunications and network license that allows the development, installation, modification, operation of networks and network applications;

- license for an IT service for the provision of services via the Internet (marketing, educational and others);

- Internet and multimedia license for developing content and distributing all kinds of goods and services via the Internet;

- real estate management license;

- general license – it provides for a wide range of activities: from the provision of consulting services to hotel, tourism and restaurant business.

Documents required for company registration

To open a company in the Dubai Internet City Free Zone, you need to submit the following documents for registration:

- application of the established form;

- copies of passports of founders, directors and managers;

- constituent documents of a legal entity that is a shareholder, as well as a decision of the board of directors to open a branch or LLC of a company in the DIC free zone (in case the company is registered as a legal entity);

- business plan of the activity.

How much does it cost to register a company in Internet City Free Zone

The cost of registering a company in the DIC free zone consists of the following expenses:

- authorized capital 50,000 AED (only for LLC companies);

- licenses – 15,000 AED;

- office rental – these costs depend on its type and size. The cost of a workplace is 35,000 AED per year, and an office of 60 sq. m – about 100,000 AED. When renting an office, you can receive up to 7 resident visas;

- business plan approval fee – 2000 AED;

- registration fee – 3510 AED.

|

OVERVIEW |

FEES |

ADDITIONALLY |

|---|---|---|

|

Registration fees |

AED 3,520/- |

Once |

|

License |

AED 15,020/segment |

1 segment costs AED 15,020. Each additional segment costs AED 10,000 |

|

Cost of resident visas |

AED 3,380 (if a person is outside the UAE) AED 4,992 (if a person is inside the UAE)*insurance is mandatory |

Visa for 3 years |

|

Visa deposit |

AED 2,500/per visa |

Returned upon visa cancellation |

|

Emigration card |

AED 2,000 |

Issued for 1 year |

|

Authorized capital |

AED 10,000 |

– |

|

OFFICE |

ADDRESS |

AREA |

PRICE |

OFFICE STATUS |

AVAILABILITY OF RESIDENT VISAS |

|---|---|---|---|---|---|

|

Business Center – Shared table |

Dubai Internet City |

desk |

AED 25,000 per year + AED 5,000 deposit |

desk |

2 visas |

|

Business Center – Individual table |

Business Center – Individual table |

desk |

AED 35,000 per year + AED 5,000 deposit |

desk |

3 visas |

|

Business Center – Office |

Dubai Internet City |

160 square feet |

AED 96,000 per year+ AED 10,000 deposit |

Renovated, with furniture |

4 visas |

|

Office |

Business Center – Individual table |

720 square feet |

AED 175.00 / sq. ft. |

Not renovated |

1 visa per 60 square feet |

Advantages of Dynasty Business Adviser for company registration in DIC FZ

Dynasty Business Adviser offers businessmen wishing to open a company in the Internet City Free Zone high-quality consulting assistance and a full range of services associated with registering a company. We guarantee:

- opening a company in DIC FZ in the shortest possible time. You will only have to visit the UAE to open a bank account;

- quick legalization of documents and submitting them for registration – this will be done by Dynasty Business Adviser specialists, since the company’s office is located in the UAE;

- accompaniment to the bank to open an account;

- attractive cost of services – we are a licensed registrar of companies in the UAE and work without intermediaries.

Call the phone number indicated on the website, or contact us in another way indicated in the contacts!