Bahrain is one of the fastest-growing countries in the Middle East. It offers favorable conditions for doing business, from low taxes to developed infrastructure. In this article, we will provide a detailed guide on how to open your business in Bahrain in 2024.

The Convenience of Doing Business in Bahrain

Bahrain ranks 43rd in the Doing Business ranking, a very high indicator for Middle Eastern countries. The government actively attracts foreign investments and creates optimal conditions for business:

- Low Taxes: Bahrain has no corporate income tax for most sectors. There is a 5% value-added tax (VAT) and no tax on dividends, interests, and royalties.

- 100% Foreign Ownership: Foreigners can fully own companies in the country without needing a local partner, simplifying the investment process for foreign companies.

- Developed Infrastructure: Bahrain boasts modern roads, ports, and airports, crucial for conducting import-export businesses. Telecommunications, financial services, and other sectors of the economy are also well-developed.

- Strategic Location: Situated in the heart of the Persian Gulf, Bahrain has convenient transportation connections with the entire region. It is also part of the GCC free trade zone, facilitating access to Gulf markets.

- Liberal Legislation: Bahrain operates under flexible commercial laws based on common law principles. There are no strict currency restrictions, and open currency positions are allowed.

Bahrain is rightly considered one of the most promising countries for investment and international business development in the Middle East. It offers all the conditions necessary for successful business operations.

In Which Industry Should You Start a Business in Bahrain?

Considering the geographical location and economic characteristics, the most promising sectors for business in Bahrain are as follows:

Financial Services

Bahrain has a well-developed banking system and operates an offshore banking sector. There is potential for creating investment and venture capital funds, fintech, and crypto projects.

Logistics and Transportation

Bahrain’s ports and airports handle significant cargo flows. One can open a company for freight forwarding, logistics, and shipping.

IT and Telecom

Bahrain has a relatively high level of information technology development and high-speed internet. This provides a good foundation for IT startups, software development, and internet services.

Tourism

In recent years, the Bahraini government has actively developed the tourism industry. Therefore, ample opportunities exist to open travel agencies, hotels, and entertainment centers.

Manufacturing

Bahrain has free economic zones where one can establish manufacturing with minimal costs and taxes.

Trade

Bahrain’s advantageous geographic location allows trading with the entire Gulf region. One can open wholesale or retail trade businesses or an online store.

The Most Profitable Business Ideas for Bahrain

In addition to traditional sectors, Bahrain has the potential to create innovative startups. Here are some business ideas with good growth prospects:

- Tourist Applications and Services (audio guides, maps, tour booking).

- Educational Online Platforms and Language Learning Applications for learning English.

- Food, Grocery, and Item Delivery Services (similar to Delivery Club, Youla in Russia).

- Marketplaces: bringing together local producers of goods and services.

- Fintech Startups: payment systems, cryptocurrency exchanges, lending services.

- Telemedicine: online consultation services with doctors.

Among the traditional options, wholesale and retail trade in clothing, electronics, and food products stand out. These niches will always be in demand in Bahrain’s growing economy.

What Are the Minimum Investments Required?

The minimum investment required to start a business in Bahrain largely depends on the industry and the scale of the project. Here are approximate amounts:

- Company registration — from $1,300.

- Expenses for obtaining licenses and permits — from $2,000.

- Office or warehouse rent — from $500 monthly.

- Employee salaries — from $800 monthly.

- Advertising and promotion — from $300 monthly.

In addition to these costs, initial capital is needed for purchasing goods, equipment, and other business needs. For a minimally viable startup in Bahrain, investments ranging from $15,000 to $50,000 are typically required.

Legal Requirements for Opening a Business in Bahrain

The main legal aspects that a foreigner needs to know before opening a company in Bahrain:

- For residents of Bahrain, the process is more straightforward, while non-residents need to obtain special permission.

- There is no minimum share capital required for company registration.

- A physical office in Bahrain is required; virtual offices are unacceptable.

- At least 51% of employees must be Bahraini citizens.

- Commercial registration and licenses for specific types of activities are required.

The complete list of requirements depends on the organizational and legal form of the business and its field of activity. In complex cases, it is advisable to consult a lawyer.

Requirements for Wages and Taxation in Bahrain

The main requirements for wages and taxes for companies in Bahrain are as follows:

- There is no minimum wage requirement.

- Social insurance contributions: 12% of the salary for Bahraini citizens, 3% for foreigners.

- Income tax for employees: absent.

- Corporate income tax: 0% for most industries.

- Value-added tax (VAT): 5% for sales within the country.

As seen, Bahrain provides significant tax benefits for businesses. This allows for company cost optimization, rapid turnover, and profit growth.

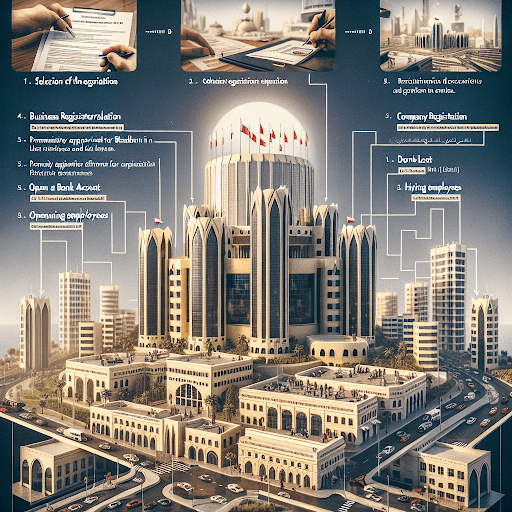

The Process of Registering a Business in Bahrain

The process of registering a business in Bahrain for foreign investors includes the following main stages:

- Choosing the legal form of organization. The most popular option is similar to our Limited Liability Company (LLC). Closed and open joint-stock companies, partnerships, and single-member companies are also standard.

- Preparation of founding documents in English, such as the articles of association and the memorandum of association. These documents outline the introductory provisions of the company’s activities.

- Obtaining preliminary approval from the Ministry of Industry, Commerce, and Tourism of Bahrain for company registration. At this stage, the company name, legal form, and types of activities are approved.

- Direct registration with the Bahrain Companies Registry and obtaining a registration certificate. Concurrently, a corporate bank account is opened. This stage takes 2 to 4 weeks.

- Obtaining special licenses and permits for specific entrepreneurial activities, such as manufacturing, trading, financial services, etc.

- Hiring local staff by legislative requirements. Renting an office or warehouse. Resolving other organizational issues to launch the business.

- Registration with tax authorities if the company plans to operate within Bahrain and be subject to VAT or excise duties.

Thus, it is possible for a foreign investor to fully establish a company in Bahrain within 1.5-3 months. Our specialists assist at all stages of business registration.

Advantages of Collaborating with Dynasty Business Adviser

Dynasty Business Adviser has extensive experience supporting businesses in Bahrain for over 7 years. During this time, we have accumulated extensive knowledge of the specifics of conducting entrepreneurial activities in this country and have established close ties with government authorities.

We offer a full range of services for the registration and legal support of companies in Bahrain, including the following:

- Developing an optimal business model considering the client’s goals and the specifics of the planned activities.

- Registration of companies of various legal forms.

- Obtaining all necessary licenses and permits.

- Opening corporate and personal bank accounts.

- Selection and rental of office space.

- Hiring personnel and visa support.

- Accounting and tax support.

- Legal support at all stages of business operation.

Thanks to established partnerships with government agencies, we conduct company registrations in 2-3 weeks instead of the market average of 1-2 months.

Additionally, our specialists will help optimize the business structure in Bahrain to minimize costs and tax burdens.

Contact Dynasty Business Adviser to open a profitable, sustainable, and utterly legal business in Bahrain. Our experts are always ready to advise on any questions about conducting business activities in this promising jurisdiction.

How We Work: Stages of Cooperation with Dynasty Business Adviser

The company Dynasty Business Adviser offers comprehensive support for businesses in Bahrain, from company registration to profitability. Let’s take a closer look at the stages of our interaction with clients:

- Consultation and business model development: Our experts will advise on all legal and tax aspects of business in Bahrain. We will study your goals and propose an optimal company structure considering the specifics of your planned activities.

- Company registration and obtaining licenses: Within 2-3 weeks, we will register your company, select office space, open a bank account, and obtain all necessary permits from the relevant Bahraini authorities.

- Staff recruitment and outsourcing: We will assist in hiring qualified local staff and foreign specialists for specific business tasks. Additionally, we provide outsourcing services by incorporating your company’s employees into our staff.

- Accounting and legal support: Our specialists will take care of accounting by Bahrain’s legislation, prepare and submit reports, and represent the interests of your company when dealing with government agencies.

- Marketing and promotion: We will develop a promotion strategy tailored to your business specifics, set up internet marketing, and organize participation in industry exhibitions and regional business events.

- Tax optimization: We will provide advice on possible tax minimization schemes, considering the specifics of Bahrain’s tax legislation.

At each stage, you will receive full support from the experienced team at Dynasty Business Adviser. Contact us to open a profitable and sustainable business in Bahrain!