The WPS salary system in UAE, or the Wage Protection System (WPS), was introduced in 2009 in the UAE to simplify payroll processes, reduce labor disputes, and enhance business efficiency. However, many new employers and employees still do not fully understand what this service is and how it works, as it is innovative and not widely known in other countries. Meanwhile, immigrants from over 200 countries arrive in the Emirates annually.

WPS is mandated by law, and companies face significant fines and negative impacts on their ratings for non-compliance. Employees should be aware of and understand their rights. At the same time, they must perform their duties conscientiously, as employers are also legally protected.

The experts at Dynasty Business Adviser, who provide legal support to individuals and businesses, raise this topic to provide as much information as possible to all interested parties. In this article, we will examine the WPS meaning in UAE, why WPS stands for salary, from the term’s origin to the intricacies of how this system works.

What is WPS in UAE?

WPS stands for Wage Protection System, an electronic service regulating salary payments in the Emirates. The system was introduced to protect workers from unscrupulous employers who delayed payments to UAE citizens, used offshore accounts for salaries, or employed illegal sources of income. Simultaneously, it was necessary to protect businesses from dishonest workers trying to get paid for incomplete or substandard work.

The development was carried out by the National Bank of the UAE in collaboration with the Ministry of Human Resources and Emiratisation.

History of WPS salary system implementation

To effectively resolve disputes between employees and employers, Ministerial Decree No. 788 on wage protection was established in the UAE in 2009. In 2016, WPS rules were strengthened by Decree No. 739. As a result, an innovative system was created to control the timely payment of salaries. Businesses can fund the payroll account in any convenient way: through banks, currency exchange offices, or licensed financial institutions.

According to WPS rules:

- employers are required to pay salaries at least once a month;

- An employee’s salary must be no less than 75% of the minimum established by WPS (since deductions from salaries are permissible);

- money must be transferred to the employee’s account in a local bank;

- the company must pay at least 70% of salaries to all employees through the service (considering unpaid leaves);

- businesses cannot impose any banking fees on employees.

Before WPS was introduced, not every worker had bank cards, so companies paid in cash. When registering for the service, business owners need to ensure that all employees have a bank account with a debit or salary card to withdraw money. If necessary, they should help open accounts for low-income workers and cover the commission costs for account maintenance.

Advantages of WPS and issues it solves

- WPS is a database that keeps records of salary payments. It helps protect the rights of all parties involved during labor disputes, resulting in fewer claims from workers.

- The automatic salary payment feature saves time and effort for employers.

- Ensures transparency in WPS salary processing time.

- The innovative system helps strengthen the image of reliable employers in the market: by registering in the system, they demonstrate their commitment to the obligations outlined in labor law.

- Thanks to the system, salary data is continuously updated at the Ministry of Labor, and compliance with payment guarantees by employers is monitored.

- Non-compliance by companies affects their rating in WPS, and their ability to obtain new work permits for employing foreign nationals legally.

WPS requirements and new rules in the UAE

In 2019, the Ministry of Human Resources issued additional provisions that clarified the WPS excluded meaning.

Among those seeking protection, certain individuals must be excluded:

- employees physically located outside the UAE;

- workers reported as absconding;

- employees with pending labor lawsuits.

New WPS rules in UAE were also introduced:

- a new employee is added to the WPS system two months after signing the employment contract;

- employers paying in cash or by check are not exempt from using the WPS system;

- no more than 10% of an employee’s salary can be deducted for any reason;

- the WPS system processes salary payments from the 1st to the 15th of each month;

- reminders are sent to employers between the 5th and 10th to deposit funds for payroll;

- if an employer ignores the reminder, the system blocks them and automatically sends information about non-payment to judicial authorities;

- if the employer manages to pay the salary by the end of the month, the block is lifted, but in case of delay, an administrative fine is imposed in addition to the block;

- delays of more than three times a year result in maximum fines, and directors and owners must attend specific lectures at the Ministry of Human Resources.

How to register WPS in UAE?

Employees do not need to register in the system themselves. However, employers must create an account on the official MOHRE website. To register an account in WPS, you will need:

- a license, confirming the legality of the company’s operations.

- bank account details in a bank located in the UAE.

- A contract with a WPS agent: this can be a bank, fintech, or exchange registered with MOHRE.

- Copies of identification documents of the company owners and all employees. Foreign nationals must also provide visas in addition to passports.

You can request WPS registration through internet banking at the financial institution where your account is opened or directly on the MOHRE website by filling out a form. You may be invited to the bank or the nearest service center to sign the contract in person. After this, your WPS account will be activated, and you will receive an employer identifier (a 13-digit code).

After uploading the necessary documents, you must agree to the system’s terms regarding salary payments within a specified time frame and the payment of service and bank fees.

How WPS salary UAE works

After registering for the service, you will need to create SIF files for all employees, payroll, undergo verification, send a payment order to the agent, and pay the salary. Let’s take a closer look at how this process works.

Preparation and submission of SIF

SIF is a file containing information about employees’ salaries. It is necessary for the Ministry and the Central Bank to verify the information correctly. First, payroll (WPS file) is checked by your agent for errors. This document is filled out each time there is an intention to pay a salary, but no less than once a month.

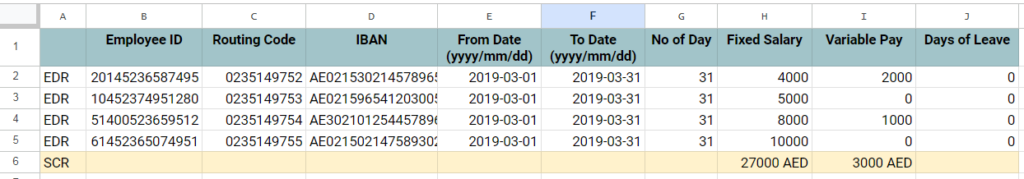

How to prepare the SIF for WPS? Start by creating an Excel file with the following cells:

Fill in the columns as follows:

- A. Information about the employee, where EDR marks the beginning of the section in the row.

- B. Employee’s labor card number (usually 14 digits).

- C. Bank routing code.

- D. Employee’s bank account number (IBAN).

- E. Start date of the payroll period.

- F. End date of the payroll period.

- G. Total number of days for which the salary is calculated.

- H. Fixed salary (rate).

- I. Variable salary (additional payments, bonuses, overtime payments, transportation, medical insurance, housing allowances, and other payments provided in the employment contract).

- J. Vacation or sick days.

The last row (Salary Control Record – SCR) is the final one. The file might look like this (*the set of numbers in the example is random):

The completed Excel file must be saved in SIF format (usually, separate software is required for this) and uploaded to the system — meaning sent to your agent through the electronic cabinet. The file name should be a combination of 25 digits, where:

- the first 13 digits — are the employer identifier;

- the next 6 digits — are the date in YYMMDD format.

- the last 6 digits — are the time of file creation in hours, minutes, and seconds.

You can always check the file naming format with your payment agent to avoid errors.

WPS salary check

Once your agent has checked the file, it will be sent to the Ministry of Labor and Employment and the Central Bank. These organizations will verify if the data is correctly formatted and whether you meet the requirement of paying each employee at least 75% of the minimum wage in Dubai or another emirate in the country. On average, the salary verification process in WPS takes up to 5 days, so it is better to prepare the necessary reports in advance.

Issuing a payment order

If there are no errors in the file, a payment order for the salary transfer will be sent to your agent by the Ministry and the Central Bank. In case of discrepancies, you will receive a notification requesting you to clarify or correct the data. Corrections should be made as soon as possible to meet the application submission deadline by the 10th of each month, considering the time needed to process salaries in WPS.

To avoid unpleasant situations like the imposition of fines, we recommend contacting our company before submitting the data. Qualified staff will help verify the accuracy of the information and provide consultation if any questions arise.

Transferring money to employee accounts

The agency transfers salaries to employees’ bank accounts after receiving a payment order from MOHRE and the Central Bank of the UAE. For the efficiency of this operation, some payment services offer a dedicated account or card for this service, making it easy to withdraw funds for salary transfers.

Fines and sanctions for non-compliance

For late payment of salaries through WPS or avoiding settlements, companies face penalties, fines, and sanctions. A salary delay is considered when the amount due to the employee is not paid within more than 15 calendar days from the expected payment date. Avoidance is defined as non-payment of salary for more than 30 calendar days.

The law №788 of 2009 initially provided only restrictions on issuing work permits. However, after amendments by decree №739 of 2016, the penalties and types of restrictions depend on the size of your company.

Fines for payment delays

For enterprises with more than 100 employees, the following sanctions are provided:

- ban on opening new companies (branches, representative offices) in the UAE;

- ban on obtaining work permits for employees;

- downgrading the company’s financial rating;

- application of sanctions to other companies owned by the same owners;

- allowing employees to stay in the country for 180 days to look for new work (the employer cannot force the employee to return after dismissal, although the extension of their work permit may be suspended).

Salary payment evasion

If the employer has not submitted salary data to WPS by the end of the month, the business will be referred to judicial authorities. A fine of 5,000 dirhams will be imposed for each affected employee or a maximum of 50,000 dirhams for multiple employees. The previous reputation of the company and the absence of a record of avoiding obligations will be decisive in the penalty calculation, for example, if the company is in the process of liquidation.

It should be noted that if small enterprises fail to pay salaries twice a year, they will receive the same penalties as companies with more than 100 employees.

If your business is facing financial difficulties and you plan to close (liquidate) the company, professional legal assistance from our experts will help you properly organize the settlement processes with employees to avoid unnecessary fines.!

How WPS works in the UAE Free Zone

All companies and their employees located in the UAE are required to register in the system. This requirement also applies to Jebel Ali (JAFZA) — one of the Free Zones. In other Zones, these rules do not currently apply.

However, please note that the law can always be supplemented or changed. Therefore, it is important to keep track of changes in legislation. Our lawyers handle this task; you can trust them to support your company.

How to work with WPS in the UAE most effectively

In this material, you have been introduced to the unique Wage Protection System UAE, which other countries are gradually adopting. To work with it competently and effectively, it is crucial to choose the right agent. The agent will ensure that:

- notifications about the need to submit SIF reports are sent on time;

- your file contains no errors or incorrectly filled fields that could result in the report being returned;

- all your employees have active accounts for payments;

- you have an account where you can securely transfer funds and withdraw them exclusively for the intended payment.

Please note that the bank (agent) does not provide consulting accounting support or legal assistance. Its tasks are limited to automating services, setting reminders, and technically verifying information. For instance, if all fields in the file are not filled out, it is immediately returned for revision.

If you need help with correctly filling out documentation, selecting a reliable agent, or preparing documents for registration in the service, you can contact our Company, Dynasty Business Adviser.

Other services we offer that may be useful for WPS registration:

- assistance in choosing a reliable agent with minimal commission fees;

- opening a corporate bank account;

- accounting support: salary accounting, payroll, balance sheet reconciliation, business auditing, and tax reporting.

Our company’s financial experts will help you navigate all the nuances of filling out salary data. If you need additional information on the operation of the payroll service, registration in WPS Dubai for offshore companies, or businesses located in specific free zones, we will be happy to provide it.

Conclusion

To summarize:

- WPS is an automated service that ensures timely salary payments. Registration is mandatory for all licensed companies operating in the UAE.

- Choosing a good agent makes the payroll process simple and efficient.

- Thanks to the WPS database, which stores information on salary amounts and payment dates, each party can protect their rights in court if necessary.

- Companies face fines and sanctions for late salary payments.

- Our specialists can help organize the payroll process through WPS.

Delegate the routine work to us so that you can focus more on developing your business in this promising country!