UAE tax residence certificate: conditions for obtaining

The UAE tax resident certificate is an official document issued by the country’s Ministry of Finance to legal entities and individuals. It is intended for presentation to the tax authorities of the state whose citizens are the individual, owners, or management of the company, if there is an agreement between the country of their permanent residence and the United Arab Emirates on the avoidance of double taxation. Let’s take a closer look at how to become a UAE tax resident.

The tax residency of Dubai and other emirates is valid for 1 year from the date of issue of the certificate for an individual and the following mandatory conditions must be met in order to obtain it:

- availability of a resident visa for an individual for at least 6 months;

- availability of a place of residence in the UAE for an individual;

- confirmation of permanent income for individuals (bank statement for 6 months);

- Immigration report to confirm your travel to the UAE.

To obtain a tax certificate, individuals today are not required to change citizenship or reside in the UAE on a permanent basis.

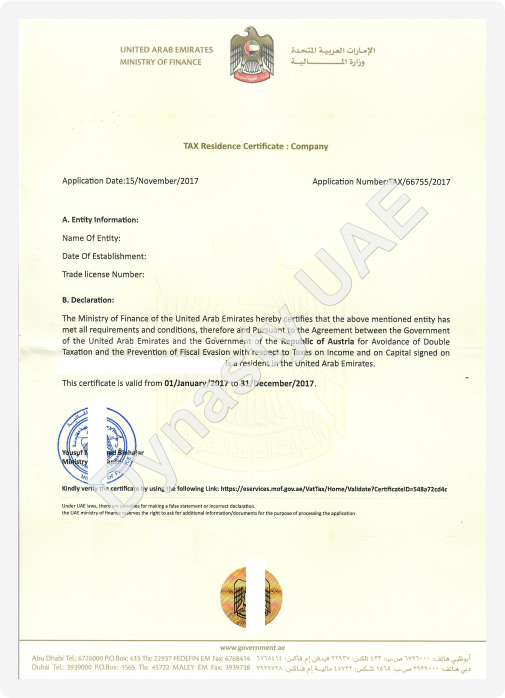

Sample of a ready-made certificate

Documents required to obtain a tax certificate

UAE tax residency for a legal entity (obtaining a certificate) requires preparation and submission of the following documents:

- constituent document on the formation of a legal entity – it must be certified by the official authorities of the UAE international companies through their registered agent.

- trade license;

- letter of application from the company;

- a copy of the ID card and passport of the first head of the legal entity;

- premises rental agreement;

- bank statement on financial transactions carried out over the last 6 months;

- a certified copy of the audit report on the financial condition of the company;

- organizational structure of the company.

The cost of a tax certificate for a legal entity is 5 000 $

*If you have all the necessary documents.

To obtain a tax residency certificate for an individual, you will need the following documents:

- copy of residence visa, ID card, and passport;

- letter of application for obtaining a certificate;

- a copy of the lease agreement, certified accordingly;

- bank statement for the last six months.

The cost of a tax certificate for an individual is 2 000 $

*If you have all the necessary documents.

Procedure for obtaining a tax residence certificate

The procedure for obtaining a residence certificate looks like the following:

- registering a company or purchasing a ready-made legal entity already registered in the UAE is the easiest, fastest, and most cost-effective way to obtain UAE tax resident status, including for individuals. After opening a company, you will need to purchase a license;

- obtaining a residence visa – individuals can receive it from the company, as well as by getting a job in the UAE or purchasing a residential property worth more than 1 million dirhams;

- opening a bank account for a company to carry out regular transactions for 1 year, as well as a personal bank account for an individual, shareholder, or head of a company – these accounts are necessary to confirm the conduct of business (to obtain a certificate of residence of a foreign company) or the availability of income of an individual in the UAE;

- submission of documents for obtaining a tax residence certificate (Tax Domicile Certificate) after 5-6 months of regular operations using a personal account for an individual and after 1 year of using a corporate account for companies.

To present it to the tax authorities of the country of destination, a legalized certificate of residence certified by the Ministry of Foreign Affairs is required.

If you want to receive a legalized UAE residency certificate without spending your time, effort, and extra finances on frequent trips to the United Arab Emirates, contact our company! Experienced Dynasty Business Adviser specialists will help you do this at an affordable price in the shortest possible time!