The ideal conditions in the UAE for conducting business activities attract people in business and investors from around the world to this country. Many are citizens of countries with imperfect taxation systems and complex bureaucratic apparatus that often pose obstacles to business development. In the absence of taxes on income, dividends, and personal profit, the possibility of duty-free import and export of goods in the Arab Emirates help to minimize expenses for business maintenance. Dubai, the second largest (after Abu Dhabi) and the most dynamically developing emirate, is very popular among foreign businessmen. We will tell you more about how to open a business in Dubai and the UAE.

Why should you choose Dubai for business registration in the UAE?

You should choose Dubai as a jurisdiction for registering your business due to many indisputable advantages of this emirate over other administrative units of the UAE:

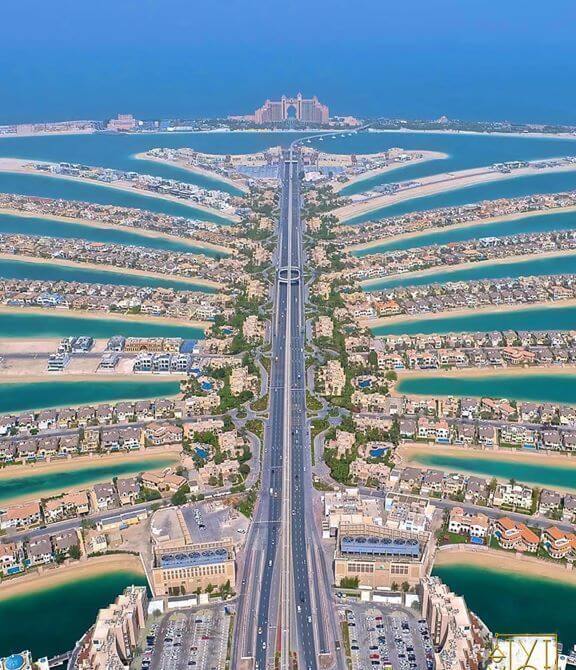

- The most developed infrastructure in the country – there are modern offices, warehouses, trade, and industrial facilities, and well-developed transport, which ensures convenient communication with the whole world;

- A transparent legal framework that protects the rights of individuals and companies. In the emirate of Dubai, there is liberal labor legislation with no quotas for the citizenship of employees. Therefore, it is easy to find cheap labor and highly qualified personnel among immigrants here;

- The most significant number of free economic zones (more than 30) among all 7 emirates. They have a tax-free regime, and the costs for registration and renewal of licenses are among the lowest in the country;

- Availability of reliable and stable financial institutions and large international banks. Dubai ranks high in the World Bank ranking among global financial centers;

- The high purchasing power of the population. Dubai is the most densely populated emirate, with a high standard of living for local citizens and immigrants with resident visas. In addition, many tourists from highly developed countries come to Dubai, making the service sector business the most promising;

- Soft tax policy about foreign companies.

In addition, having a business in Dubai is prestigious. Companies with jurisdiction in this region have a good reputation, contributing to the more successful conduct of business within the Arab Emirates and in relations with international partners.

Opening a business in the UAE and Dubai: where to start

If you want to organize a new business in the United Arab Emirates or transfer part of your existing business, open a branch of the company, follow the algorithm of actions:

- Сhoose the direction of business activity that you want to develop in the UAE;

- Study the competitors’ markets and analyze their pricing policy to understand whether it will be profitable for you to sell your goods or services at the same price. You should not count on attracting buyers at lower prices since cheap goods are not in demand in Dubai, but an optimal combination of price and quality;

- Decide on the company type. To start a business in the UAE, you should choose a local company (CCL). Today, it can be registered 100% to a foreign owner (upon obtaining a special permit from the authorities of the emirate). Open a company in one of the free zones would be a more profitable option, but in this case, you will be able to conduct activities in the country outside your zone only through a distributor company;

- Draw up a business plan and calculate the necessary start-up capital, taking into account unplanned expenses and the fact that it will take a certain amount of time to promote your business;

- Collect and legalize a package of documents necessary for business registration in the Emirates, obtaining licenses, permits and opening a bank account;

- Rent office, warehouse, and work premises purchase machinery and equipment;

- Develop a marketing plan.

It is better to entrust the company’s registration and obtain licenses to specialists who are well versed in the intricacies of local legislation. Economists, lawyers, and other employees of Dynasty Business Adviser provide practical help in this regard.

The most in-demand business niches in the emirate of Dubai

Due to the territorial specificity of Dubai and the internal policy of the government, the following areas of business are the most popular here:

- IT industry – the demand for computer technologies in all areas of modern activity creates good prospects for the development of business related to software development, Internet marketing, advertising, and cyber security;

- Tourist activity is a fairly profitable niche, which has become much more accessible today than in 2018, when registering tourist companies in the UAE became easier. Even though opening a business in Dubai in this field of activity is more expensive than in other emirates, a large annual flow of tourists guarantees its success;

- Trade: international, domestic and electronic (e-commerce). The high demand in the domestic market for many types of goods creates good prospects for their import to the UAE and sale in the domestic market. The presence of the country’s largest seaport and international airport allows for successful export and re-export of goods;

- Construction: activity related to the construction of real estate (the Department of Economic Development issues licenses for it), engineering and design of construction objects, production of construction materials;

- Financial and business services, including investment, debt funds management, accounting and auditing, trust management of property, and family trust funds.

Demanded niches of business activity in Dubai include the work of logistics companies, activity in the real estate market, or the sphere of providing services to the population.

How long does registering a business in the United Arab Emirates take?

The term of opening a business in the United Arab Emirates varies depending on the emirate, the free economic zone, the type of company (local, in the free zone, offshore), and the kind of activity (it requires approval or obtaining additional permits from government authorities).

In some free zones of Dubai, you can register a business in just 2-3 days, while in others, it will take 4-5 weeks or even more open. This is caused by a more thorough check of the founders by the government of the free economic zone through a unique control system.

How much does it cost to open a business in Dubai?

To open a business in the Emirates, you need start-up capital. At the same time, the costs of registering a company in Dubai are higher than opening a similar company in the other six emirates. But, if you decide to become a business owner in the most prestigious region of the country with all the resulting benefits, you will have to spend some money.

Depending on the company type, the office size, the number of licenses, and resident visas for employees, the registration cost is about $12,000-20,000. At the same time, it is possible to open an offshore company much cheaper, and the registration of some companies with an office will require more than $20,000.

What pitfalls can come across when doing business in the UAE?

When conducting business in the United Arab Emirates, you may face specific difficulties:

- High cost of living, including real estate rent, school or university education, and other expenses. At the same time, the cost of living in Dubai is higher than in other emirates;

- Peculiarities of local mentality, culture, and religion;

- The need to respect the traditions of the UAE.

Living in the UAE, one should adhere to a strict clothing style to avoid violating religious traditions woven into everyday life. When communicating with local business partners, one must be prepared for a different attitude of Arabs to day timing than is accepted by Europeans. Here, business meetings do not always start on time and are often delayed due to conversations on abstract topics.

Dynasty Business Adviser will not only advise you on how to open your business in Dubai or another emirate of the UAE but also help you do it in the shortest possible time and with the lowest financial costs.