Jebel Ali Free Zone: Huge Opportunities for International Business

JAFZA is just minutes from the 8th largest cargo airport, Dubai International Airport, which can handle up to 2.7 million metric tons of cargo. This free zone is also connected to Dubai’s new airport, Al Maktoum Airport. To ensure a smooth cargo transportation process, JAFZA offers a customs corridor that connects Jebel Ali Port and Al Maktoum Airport.

Jebel Ali Free Zone Dubai offers all types of business premises rentals in the UAE. Here you can rent land, warehouses, exhibition halls, offices, shops, premises in a high-tech park, as well as housing for workers.

To date, more than 7,000 companies are registered in this free zone. Its business model is well established and this is demonstrated by the fact that over 500 of the world’s largest enterprises have chosen JAFZA Dubai as one of their bases.

The main advantages of registering a company in the Jebel Ali Free Zone

Establishing a company in JAFZA gives a foreign investor a number of significant advantages:

- The investor has the right to 100% ownership.

- No corporate tax for 50 years.

- Possibility of 100% capital repatriation.

- No import or export duties.

- No currency restrictions.

- Companies in the Jebel Ali Free Zone can hire foreign employees and issue visas for them.

- Optimal logistics infrastructure offering the best air, sea, road and rail routes.

- The only free zone in the world, located next to the largest airport and largest seaport.

- Possibility of obtaining a loan secured by the client’s premises built on leased land.

- Own customs.

- A professional team of specialists assists clients in registering and operating companies.

- Low cost of utilities.

- Jebel Ali Free Zone companies have a wide range of specialized premises to suit individual needs.

- Wide range of licenses and activities.

- The presence of world-renowned companies and investors facilitates business relationships and creates unlimited business opportunities.

Company activities in Jebel Ali Free Zone (Jafza)

Types of Companies in Jebel Ali

Depending on the number of shareholders and the nature of the business, JAFZA offers various types of companies:

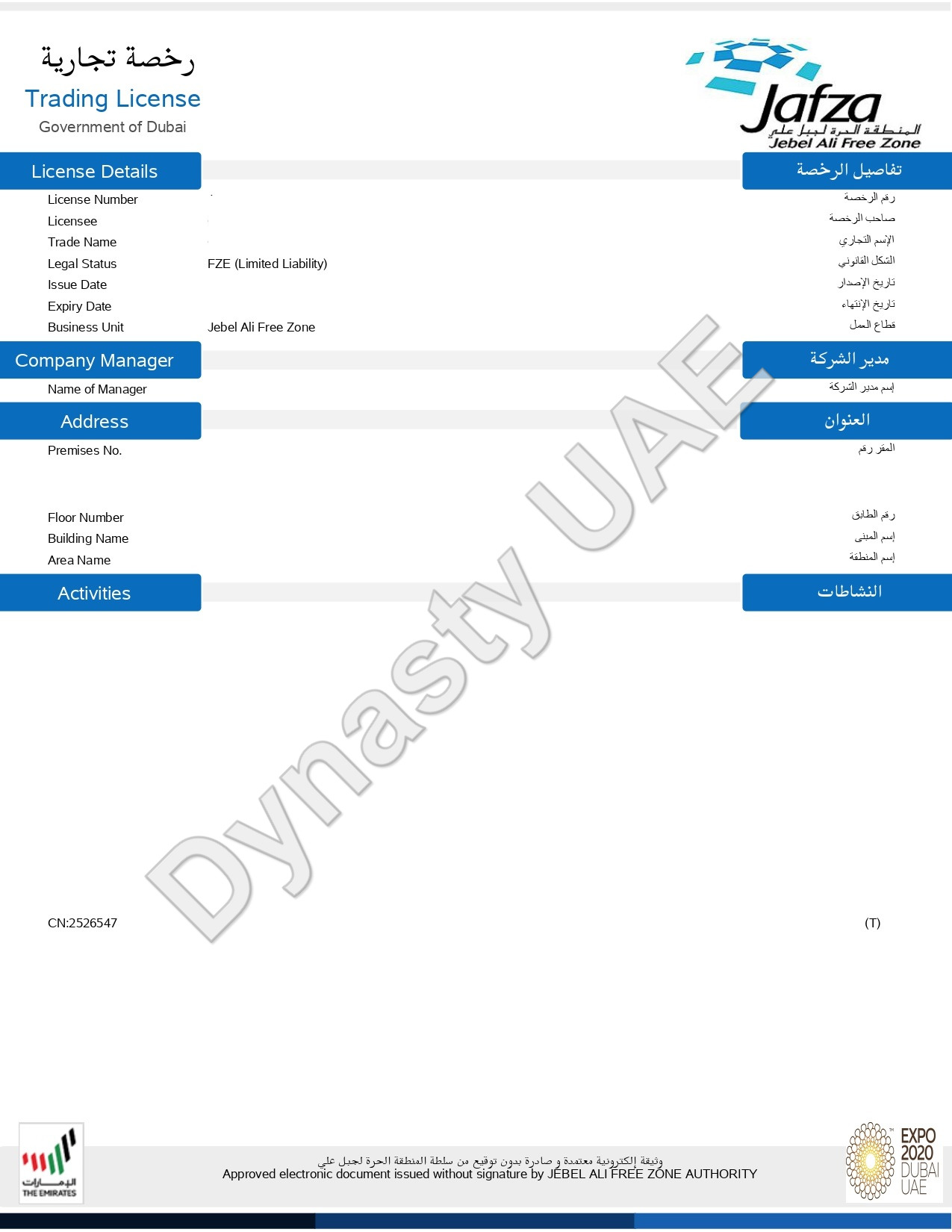

- Free Zone Establishment (FZE) companies in JAFZA are limited liability companies with one shareholder. FZE must state in all transactions, contracts, advertisements, invoices, correspondence and printed materials that its liability is limited. The liability of a shareholder to FZE is limited to the capital paid up by the shareholder of the company.

- A Free Zone Company (FZCO) is a limited liability company with a minimum of 2 and a maximum of 50 shareholders.

- A public limited company (PLC) is a limited liability company with two or more shareholders. Once a company is registered in the Jebel Ali Free Zone, the company may offer its shares for public subscription in accordance with the Market Laws.

- Branch of an existing company – a branch is considered one legal entity with its parent company. A company registered outside the Jebel Ali Free Zone (in or outside the UAE) can establish a branch in Jebel Ali UAE. A subsidiary company is 100% owned by the parent company, operates under the same name and is engaged in the same business.

Types of Jebel Ali Free Zone licenses

The type of license you will need to operate in the Jebel Ali Free Zone will depend on the type of activity:

- Trade license – allows the holder to import, export, sell and store the products specified in the license. In addition, there is a General Trading License, which gives the holder access to a wider range of activities and grants a wider range of products in the license. A general trading license in Jebel Ali Free Zone in Dubai is more expensive than a regular one.

- Service License – allows the owner to provide the services specified in the license. The service sector includes, for example, financial consulting, banking, accounting services, construction contracts, etc.

- It is possible to obtain a logistics license. The logistics license allows the company to provide logistics services such as cargo handling (sea, air, land), warehousing, storage, parking, transshipment and distribution in the JAFZA Free Zone.

- Industrial license – allows the holder to import raw materials, produce specified products and export finished products. In addition, there is a National Industrial License issued to manufacturing companies that are at least 51% owned by citizens of countries belonging to the Gulf Cooperation Council. Companies in the Jebel Ali Industrial Zone with such a license provide the holder with the same status as local companies or companies owned by citizens of the Gulf Cooperation Council countries in the UAE.

- E-commerce license – an e-commerce license allows you to buy and sell goods and services over electronic networks using electronic payment systems.

- Innovation license – a license that allows you to develop new products and services.

Cost of services

|

TYPE OF ACTIVITY |

PRICE |

TYPE OF PAYMENT |

|---|---|---|

|

Free zone company (several shareholders) |

5,000 AED |

One-time fee |

|

Establishment of a free zone (one shareholder) |

5,000 AED |

One-time fee |

|

Branch |

5,000 AED | One-time fee |

|

TYPE OF ACTIVITY |

PRICE |

TYPE OF PAYMENT |

|---|---|---|

|

Trade license (maximum 7 activities from one group) |

5,000 AED |

Annually |

|

Trade license (maximum 12 activities from two groups) |

8,500 AED |

Annually |

|

General trade license (the company must apply for an office with an area of at least 27 sq.m.) |

15,000 AED |

Annually |

|

Logistics license |

15,000 AED |

Annually |

|

Service license |

5,000 AED |

Annually |

|

Industrial license |

5,000 AED |

Annually |

|

E-commerce license (requires approval from the UAE Telecommunications Regulatory Authority (TRA)) |

30,000 AED | Annually |

|

Holding license (the minimum authorized capital of the holding company is AED 10,000,000) |

30,000 AED | Annually |

|

TYPE OF ACTIVITY |

PRICE |

TYPE OF PAYMENT |

|---|---|---|

|

Resolution of the Board |

525 AED Now ‘0’ |

|

|

MOA |

600 AED Now ‘0’ |

|

|

Sample signature |

50 AED Now ‘0’ |

|

|

Application processing fees |

525 AED Now ‘0’ |

Rent of premises cost

|

TYPE OF PREMISES |

OVERVIEW |

PRICE |

NUMBER OF VISAS |

|---|---|---|---|

|

Workstation |

The smallest object we can offer you is a workstation. | AED 30,000 per year + 10% security deposit of the total rent, one-time payment with the possibility of return + insurance 100 AED per year. | You will be able to apply for 2 visas |

|

Office |

The minimum office size is about 27 square meters. | Office rent cost ranges from 1,400 to 2,000 dirhams per square meter per year (depending on the location of the office). Deposit of 10% of the total rental amount, one-time with the possibility of a refund. Insurance – 4 AED per sq.m. per year. | We issue one work visa for every 9 sq.m. of a rented office. |

|

Ready-made warehouses with an office |

The cost of renting a warehouse is from 450 to 650 AED per sq.m. per year. 10% of the annual rent as collateral, refundable lump-sum payment of 2% of the annual rent (public health fee) per year. Insurance fees – 300 AED per year. | ||

|

Exhibition hall |

Area: 772 and 890 square meters. | 10% of the annual rent as a refundable security deposit – a one-time payment. 2% of the annual rent – public health fee – per year. Insurance fees are 1,000 UAE dirhams per year. | |

|

Land plot |

From 40 to 100 dirhams per square meter per year. 2% of annual rent in the form of health care fees per year. The rent depends on the location of the plot. |

Computer Immigration Card (CIC): 2,000 UAE dirhams per year.

* The cost of each work visa is about 100 UAE dirhams ( Valid for 3 years), including Emirates ID and medical fees. The manager (license holder) must have a Jafza Visa. Please note that the approving authority of the visa is the General Directorate for Residents and Foreigners.