Key features of doing business in UAE Free Economic Zones include:

- 100% foreign ownership of the business by founders/shareholders.

- In some free zones, no initial capital requirement is mandated, or the amount is not fixed by the FEZ authority.

- No customs duties on the import and export of any group of goods.

- No restrictions on capital and profit repatriation.

- High level of confidentiality.

- Ability to open a bank account in the UAE.

Free economic zones of the UAE and their features

DMCC Dubai

It is the largest and fastest-growing free zone, as confirmed by the award in the “Global Free Zone of the Year” nomination, which was received for two years in a row.

DMCC Dubai

It is the largest and fastest-growing free zone, as confirmed by the award in the “Global Free Zone of the Year” nomination, which was received for two years in a row.

Umm Al Quwain Free Zone

A great platform for startups, and small and medium enterprises in the UAE.

Umm Al Quwain Free Zone

A great platform for startups, and small and medium enterprises in the UAE.

DWC FREE ZONE DUBAI

Was founded in 2006 and today is one of the strategic business centers of Dubai.

DWC FREE ZONE DUBAI

Was founded in 2006 and today is one of the strategic business centers of Dubai.

Ajman Free Zone

Attractive for new companies, it is profitable to open trading, consulting, and manufacturing companies. Availability of inexpensive warehouses and a favorable logistics network, located at the entrance to the Persian Gulf.

Ajman Free Zone

Attractive for new companies, it is profitable to open trading, consulting, and manufacturing companies. Availability of inexpensive warehouses and a favorable logistics network, located at the entrance to the Persian Gulf.

Ajman media city free zone

The newest free zone in the United Arab Emirates.

Ajman media city free zone

The newest free zone in the United Arab Emirates.

DIFC Freezone

This free zone specializes in opening financial licenses such as for finance, banking, asset management, and insurance, and is located in the center of Dubai. There are really prestigious offices here.

DIFC Freezone

This free zone specializes in opening financial licenses such as for finance, banking, asset management, and insurance, and is located in the center of Dubai. There are really prestigious offices here.

Internet City Free Zone

An information technology park developed by the Government of Dubai. Suitable for registering large IT companies.

Internet City Free Zone

An information technology park developed by the Government of Dubai. Suitable for registering large IT companies.

Sharjah Media Zone

A global hub for start-ups and entrepreneurs in the media and technology sectors.

Sharjah Media Zone

A global hub for start-ups and entrepreneurs in the media and technology sectors.

The basics of legislation regulating Free Economic Zones

From a commercial perspective, the emirates offer unique opportunities for both novice entrepreneurs and experienced businesspeople looking to invest in the development of their ventures outside their home country. The legislative framework of the emirates is very flexible in this regard.

The main distinctive features of UAE legislation that ensure a regular influx of foreign investors include:

- minimal corporate taxes compared to systems of taxation in Europe and the United States;

- export-import incentives;

- simplified customs clearance;

- active support for startups.

Economic success and prosperity of the country are top priorities for the government. A significant portion of the UAE’s GDP growth is driven by the FEZ.

How to choose a FEZ?

At first glance, choosing the best free zone in UAE among the numerous options available can be challenging, as each free zone has its own advantages and disadvantages for different types of businesses.

Key rules and steps for selecting a free zone in Dubai and other emirates:

- First, determine all the types of activities permissible under a single license within a specific free zone. Keep in mind that increasing the number of activities proportionally increases the cost of the license.

- To legalize your business in the UAE, having an office is mandatory. Therefore, when selecting premises, consider the cost of rent/purchase, and choose the type of building that meets the needs of your business operations. The business space should also align with the number of resident visas required for your company’s staff in various cities across the UAE.

- Plan your logistics in advance (especially relevant for trading companies). For instance, to reduce transportation costs, placing a warehouse near an airport or seaport is an optimal choice.

- Most free zones require the deposit of share capital in the form of a deposit into the account of the chosen freezone authority Dubai or the company’s account upon its establishment.

- Ensure there are no restrictions on attracting shareholders. In some free zones, there are bans on the activities of citizens from certain countries.

- Confirm the availability of incentives for regular submission of financial reports and whether an annual audit report is required.

- Familiarize yourself with the nuances of opening a bank account, as the reputation of the free zone plays a significant role in registering a bank account.

- Properly handle the No Objection Certificate (NOC) if applicable. This refers to written confirmation from your current employer stating that they do not object to you starting a new business in a specific free zone.

- The main cost components are the license fee, company registration fee, and rental costs.

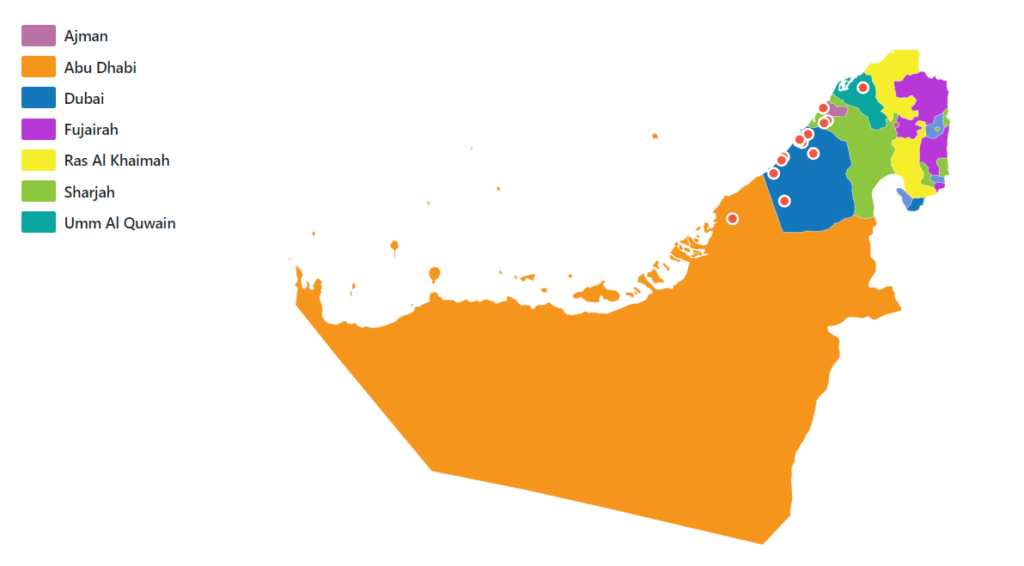

Map of free zones in the UAE

Below, we will examine the features of popular free zones depending on their type, geography, and zone administration requirements to gain a deeper understanding of what a free economic zone means in terms of individual territorial units.

What are the free zones in Dubai?

Freezone areas in Dubai have created an extremely favorable climate for foreign business ownership. A significant advantage of this best free zone in Dubai is the ability to attract shareholders from countries marked as “high-risk”. However, an audit is required in each of the zones described below.

In the table below, we will structure information of Dubai’s free zone locations and the current requirements for setting up a company in this emirate. The cheapest freezone in Dubai offers an attractive option for businesses looking to establish a presence in this dynamic market.

| Free Zone Name | Minimum Share Capital Requirement (in AED) | Time to Set Up a Company in the Free Zone, days | Permitted Activities | Key Features |

|---|---|---|---|---|

| DMCC (Dubai Multi Commodities Centre) | 50000 | 20-25 | Trading, Services | The most prestigious and fastest-growing free zone |

| DWC (Dubai South Free Zone) | 300000 | 15-20 | Services, Manufacturing, Trading | No need to deposit share capital in a bank account |

| JAFZA (Jebel Ali Free Zone) | No minimum amount | 15-25 | Services, Trading, Manufacturing | Founders determine the capital amount to be deposited as mandatory |

| DAFZA (Dubai Airport Free Zone) | 1000 | 10-20 | Trading, Manufacturing, Professional Activities | Versatile free zone |

| MFZ (Meydan Free Zone) | 100000 | 2-5 | Manufacturing, Trading, Professional Activities | No requirement to deposit capital in a bank account |

| DIC (Dubai Internet City) | 50000 | 20-25 | IT Services | 100% focus on information technology |

| DTEC (Dubai Technology Entrepreneur Campus) | 10000 | 20-25 | Services | Allows for a virtual office with a maximum of 2 resident visas |

| DIFC (Dubai International Financial Centre) | 185000 | 28-42 | Financial Sector | The only economic zone in Dubai currently operating in this sector |

| DMC (Dubai Media City) | 50000 | 20-25 | Media | Also suitable for freelancers |

| DKP (Dubai Knowledge Park) | 50000 | 20-25 | Education, HR Management | Also suitable for business consulting in the education sector |

| DHCC (Dubai HealthCare City) | 50000 | 20-35 | Medical Services | When purchasing a clinic license, the capital requirement increases to AED 300,000 |

| DAZ (Dubai Auto Zone) | 50000 | 30-40 | Vehicle Trading (Import-Export), Auto Insurance | Regulated by Jebel Ali Free Zone (JAFZA) |

| DSO (Dubai Silicon Oasis) | 100000 | 15-20 | Manufacturing, Trading, Services | Silicon Valley offers favorable conditions to new market participants in exchange for a share of the created company’s profit |

| DPC (Dubai Production City) | 10000 | 15-20 | Various Manufacturing Sectors, Trading Companies, Industrial Services | Part of Tecom Group |

| DWTC (Dubai World Trade Center) | 300000 | 21-30 | Trading, Exhibition and Event Management | FEZ of the Dubai World Trade Centre |

| DOC (Dubai Outsource City) | 300000 | 21-30 | Accounting and Financial Services, Sales and Data Centers, including Call Centers | Like DPC, part of Tecom Group |

| DGDP (Dubai Gold and Diamond Park) | 300000 | 21-30 | Trading, Manufacturing | Lease agreements for retail space, warehouses, and office spaces are concluded with EMAAR |

| Dubai Scienсe Park (DSP) | 300000 | 21-30 | International Trade | Part of the Meydan free zone. No physical real estate leasing (only virtual offices). Corporate and personal tax holidays up to 50 years |

| DIAC (Dubai International Academic City) | 300000 | 21-30 | Educational Institutions | Dubai Academic City also offers hot desk rentals for freelancers |

| D3 (Dubai Design District) | 50000 | 21-30 | Manufacturing (Cosmetics, Clothing), Modeling, Event Management, Business Consulting | Office space can be rented without a license for freezone companies in Dubai |

| DIHC (Dubai International Humanitarian City) | 50000 | 30-90 | Any activity related to providing humanitarian aid | Proof of humanitarian activities is required. Limited license duration (up to 2 years) |

Free Zones Abu Dhabi

| Free Zone Name | Minimum Share Capital Requirement (in AED) | Time to Set Up a Company in the Free Zone, days | Permitted Activities | Key Features |

|---|---|---|---|---|

| ADGM (Abu Dhabi Global Market) | 185000 | 5 | Insurance, Banking, Finance, Asset Management | Optimal for obtaining blockchain and cryptocurrency licenses. Possibility to lease actual or virtual office space |

| MCFZ (Masdar City Free Zone) | 50000 | 14-20 | Eco-technology, Alternative Energy Systems | Possibility to lease both physical and virtual offices |

| TwoFour54 Media and Entertainment Hub | No fixed minimum | 10-15 | Media and Service Activities, Freelance | Convenient location (logistics-wise). Virtual space rental available for selected activities |

| KIZAD (Khalifa Industrial Zone Abu Dhabi) | 150000 | 21-28 | Industry, Trading | Financial industrial free zone with E11 highway frontage for KIZAD free zone companies |

Free Zones in Sharjah

The main advantage of doing business in the Emirate of Sharjah is its access to two major ports (a node on the Indian Ocean coast and a hub in the Persian Gulf).

| Free Zone Name | Minimum Share Capital Requirement (in AED) | Time to Set Up a Company in the Free Zone, days | Permitted Activities | Key Features |

|---|---|---|---|---|

| SPFZ (Sharjah Publishing Free Zone) | 50000 | 2-5 | Media business and creative activities (publishing), printing | Renting an office (furnished or unfurnished) allows for up to five visa quotas |

| SAIF (Sharjah Airport Free Zone) | 150000 | 6-7 | Services sector, heavy/light industry, trading companies | In addition to offices, it is possible to rent land plots and warehouses for most types of activities |

| HAFZA (Hamriyah Free Zone) | 150000 | 7-10 | Shipping industry, gas, metallurgy, oil and petrochemical industries, construction and timber, perfume production | In addition to commercial property and land, accommodation for hired personnel can be rented |

Free Zones in Ras Al Khaimah

| Free Zone Name | Minimum Share Capital Requirement (in AED) | Time to Set Up a Company in the Free Zone, days | Permitted Activities | Key Features |

|---|---|---|---|---|

| RAKEZ (Ras Al Khaimah Economic Zone) | 100000 | 2-4 | Trading, industry, services (more than 50 sectors) | The free zone offers customizable solutions tailored to both offshore and onshore companies |

| RAKIA (RAK Investment Authority) | 100000 | 7-10 | Services, various industrial sectors, trading enterprises | Strategic location with two major industrial parks (Al Ghail, Al Hamra) |

| RAK FTZ (RAK Free Trade Zone) | No fixed minimum amount | 10 | Education (academic zone), industry and trade (technology, industrial, and business parks) | Flexible business operation conditions |

Ajman Free Zones

| Free Zone Name | Minimum Share Capital Requirement (in AED) | Time to Set Up a Company in the Free Zone, days | Permitted Activities | Key Features |

|---|---|---|---|---|

| AFZA (Ajman Free Zone) | 185000 | 10-12 | E-commerce, industry, services, retail | License fees can be divided into installments based on the payment plan (monthly, semi-annually, quarterly, annually) |

| AMC (Ajman Media City) | 100000 | 5-7 | Specific types of services and trade activities, media business | Flexibility to combine different types of activities under one license |

Fujairah Free Zones

| Free Zone Name | Minimum Share Capital Requirement (in AED) | Time to Set Up a Company in the Free Zone, days | Permitted Activities | Key Features |

|---|---|---|---|---|

| IFZA (International Free Zone Authority) | 150000 | 2-3 | Provision of services including consultancy, trading | No need for founders to be present (with UAE entry stamp) |

| FFZ (Fujairah Free Zone) | 150000 | 6-7 | Re-export/export, import of goods | The zone has a container terminal. The cost of setting up a company is lower compared to similar procedures in Dubai free zones |

| FCC (Fujаirah Creative City) | 150000 | 6-7 | Services only | Low registration fees and no requirement for annual audit reports. It is the only free zone where no written employer consent is needed to start a business |

Can a company be registered in a free zone but operate in another?

Registering a company in a UAE free zone means that your business activities are restricted to the specific economic space of the chosen free zone. The scope of your business operations is strictly defined by the license you obtain.

Providing services, engaging in trade, or manufacturing outside the chosen free zone is prohibited.

If the business owner aims to collaborate with partners outside their free zone, they must use the services of a distributor or intermediary.

Free Zone tax legislation

Entities registered in an international free zone in the UAE are subject to the following taxes:

- 9% corporate tax: A 9% corporate tax is levied on income exceeding AED 375,000. If the taxable income does not exceed this threshold, no tax is imposed, and the rate remains at 0%. Companies engaged in qualifying activities within designated free economic zones may be exempt from the 9% tax, provided certain conditions are met.

- 5% VAT: It applies to most goods and services if the total revenue in the reporting period exceeds AED 375,000. Some activities may qualify for a 0% VAT rate.

To avoid financial risks associated with penalties for violating UAE tax laws, it is crucial to maintain accurate and consistent accounting records. Experts from Dynasty Business Adviser can manage this task, eliminating the need for an in-house accounting team.

*Designated Free Zones:

Abu Dhabi:

- Free Trade Zone of Khalifa Port;

- Abu Dhabi Airport Free Zone;

- Khalifa Industrial Zone;

- Al Ain International Airport Free Zone;

- Al Butain International Airport Free Zone.

Dubai:

- Jebel Ali Free Zone (North-South);

- Dubai Cars and Automotive Zone (DUCAMZ);

- Dubai Textile City;

- Free Zone Area in Al Quoz;

- Free Zone Area in Al Qusais;

- Dubai Aviation City;

- Dubai Airport Free Zone;

- International Humanitarian City Jebel Ali.

Sharjah:

- Hamriyah Free Zone;

- Sharjah Airport International Free Zone.

Ajman:

- Ajman Free Zone.

Umm Al Quwain:

- Umm Al Quwain Free Trade Zone in Ahmed Bin Rashid Port;

- Umm Al Quwain Free Trade Zone on Sheikh Monhammed Bin Zayed Road.

Ras Al Khaimah:

- RAK Free Trade Zone;

- RAK Maritime City Free Zone;

- RAK Airport Free Zone.

Fujairah:

- Fujairah Free Zone;

- Fujairah Oil Industry Zone (FOIZ).

Where is the best freezone in UAE to start a business?

The optimal location for starting a business in the UAE largely depends on the industry and the budget the future business owner is willing to allocate.

If you are in the process of selecting a profitable business sector, we recommend exploring the top 7 business ideas in Dubai, Dubai is the largest emirate in the UAE and offers company registration in the highest number of free trade zones Dubai (currently over twenty). Carefully weigh the pros and cons of each free zone, aligning your choice with your individual needs and preferences for business setup Dubai free zones.

Partner with Us

By partnering with “Dynasty Business Adviser”, you will receive:

- qualified and prompt assistance from experienced specialists on issues of activity in the free economic zones of the emirates;

- a comprehensive range of services to help your new company enter the UAE market, from planning to achieving your first profit.

- a tailored approach to solving problems and achieving client goals.

- accounting support (if needed).

We work without intermediaries, ensuring complete confidentiality and anonymity for you.

Dynasty Business Adviser is a reliable partner for opening companies in FEZ, having many years of experience in business registration and support will help you to choose the most suitable FEZ based on the specifics of your business.