Registering a holding company in the UAE solves these problems. There are jurisdictions where dividends and capital gains are not taxed, and corporate tax for most types of activities is 0%. By combining subsidiaries under a holding company, you get a single management centre, reduce your tax burden, and reliably protect your assets. We offer comprehensive support: from choosing the form of the holding company and turnkey company registration to accounting and financial reporting.

Holding company in the UAE: what it is and what a holding company does

A holding company is a legal structure that owns shares in other businesses and manages them through a single centre. Unlike operating companies, its task is not production or trade, but asset control, profit distribution, and capital protection.

The main advantage of registering a holding company in the UAE is the best tax conditions and security of jurisdiction. Here, dividends and capital gains are exempt from taxation, corporate tax for most types of activities is 0%, and double taxation agreements have been concluded with more than 140 countries. This makes the UAE one of the most profitable and reliable places to set up a holding structure.

Types of holding companies in the UAE

Let’s have a look at what you need to know about the types of holding companies and what this affects. Depending on the owner’s goals, a project can be created:

- only for asset management (without operational activities),

- for conducting commerce (with the right to participate in transactions and receive income),

- as a mixed type, combining control over subsidiaries and operational functions.

You can read more about the differences and practical examples in the informative article about holding companies.

Once the goals and type of management have been determined, the next step is to choose a holding model in the UAE.

There are several models of holding structures in the UAE. We will consider the four main ones that are used most often. Each of them has its own characteristics, advantages, and limitations. The choice of the appropriate option depends on the business objectives: tax optimisation, asset protection, access to financing, or convenience of owning international projects.

International holding company in the UAE

An international holding company in the UAE is a parent company that owns shares in foreign subsidiaries. This form of business acts as a single centre for asset management and profit distribution from different countries. Registration is possible both on the mainland and in free economic zones, where a legal entity must meet the requirements of economic presence (ESR), confirming its actual activity in the country.

Advantages of registering an international holding company:

- Dividends and capital gains received by an international holding company in the UAE are completely exempt from taxation, which allows you to retain profits and direct them towards business development.

- The UAE has signed more than 140 double taxation agreements, allowing companies to operate in different countries without the risk of double taxation of the same income.

- Banks in the UAE are willing to open corporate accounts for international holding companies, considering such companies to be reliable clients and providing them with access to modern financial services.

Disadvantages of the structure:

- It is necessary to pay for the services of auditors, maintain accounting records, and support office infrastructure.

- For an international holding company, it is mandatory to prepare annual financial statements in accordance with international standards and have them audited by an independent licensed auditor in the UAE.

Offshore holding in the UAE

An offshore holding in the UAE is a legal entity registered in the Emirates’ offshore zone (e.g., JAFZA Offshore or RAK ICC) for the purpose of owning and structuring assets.

There are restrictions on registering a holding company offshore: companies are prohibited from conducting business in the country.

This form is used only for capital management, participation in international projects, and tax optimisation.

Advantages of establishing an offshore holding company:

- Lower registration and maintenance costs than in mainland and free zones.

- No mandatory reporting and auditing, which reduces administrative costs.

- Ability to own foreign assets and participate in international transactions.

Cons:

- Limited opportunities for opening corporate bank accounts in the Emirates.

- Lower level of trust from international counterparties compared to mainland and free zones.

Holdings in free economic zones (FEZ)

Free economic zones in the UAE are specially created territories with preferential conditions for business. Each zone has its own registration rules, tax incentives and requirements for companies. A holding company registered in an FEZ has the right to own assets within and outside the country, as well as to use simplified business procedures.

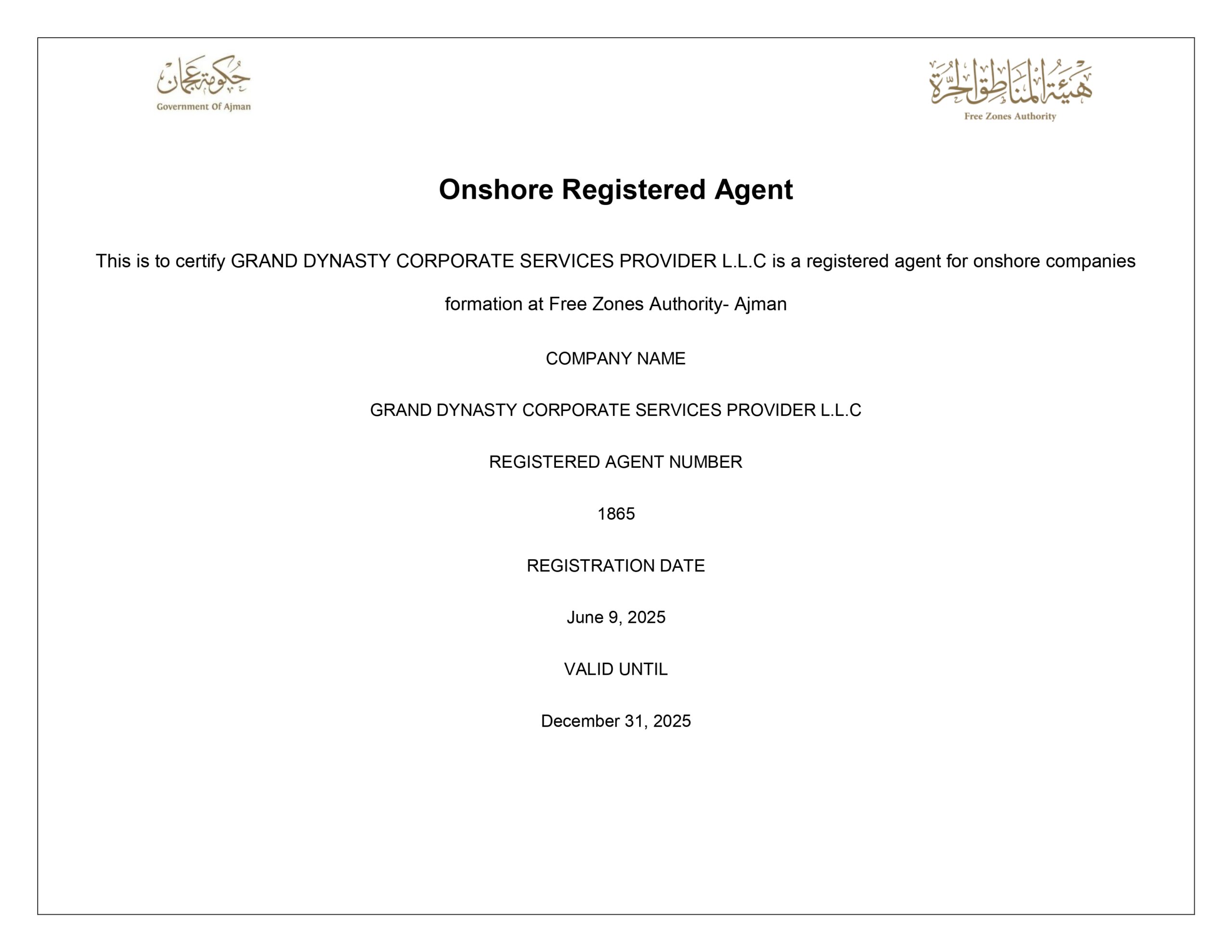

Popular registration zones: DMCC, Meydan, IFZA, RAKEZ. They differ in terms of registration costs, economic presence requirements (ESR) and banking acceptability.

Key differences between zones:

- DMCC (Dubai Multi Commodities Centre) is considered the most prestigious free zone: registration here is more expensive, ESR requirements are strict, but banks are willing to open accounts for companies established in this jurisdiction.

- В Meydan Free Zone, registration is significantly cheaper, and the choice of licences is more flexible. ESR obligations are present, but they are softer than in DMCC, and bank acceptability is rated as average.

- IFZA (International Free Zone Authority) is often chosen by start-ups due to its low cost and simple conditions. ESR requirements are simplified here, and bank confidence is rated above average. An additional advantage is the prestige of the jurisdiction due to its location in Dubai.

- RAKEZ (Ras Al Khaimah Economic Zone) is a budget option: ESR requirements are lenient, but the jurisdiction’s international reputation is weaker. It should be noted that this may complicate settlements with foreign partners.

➕ Pros:

- Preferential tax regimes and simplified business rules.

- Ability to own assets within the UAE and abroad.

- More flexible staffing requirements.

- Prestigious jurisdiction increases the trust of international partners (especially DMCC).

➖ Cons:

- Additional approval is required to enter the UAE domestic market.

- The cost of registration is higher than for offshore companies.

- Banking acceptability depends on the chosen zone: it is lower in budget jurisdictions.

Mainland holding companies

The main difference between a mainland holding company is the ability to directly own assets and participate in transactions on the domestic market. The company must have an office, employees, and confirm its actual activities in the country.

From 2023, mainland companies will be subject to a 9% corporate tax rate, which must be taken into account when planning expenses.

It should be noted that this type of holding company structure is considered the most reliable and understandable for the state and international partners.

➕ Advantages of establishing a holding company on the mainland:

- Full access to the UAE domestic market and the ability to own assets without territorial restrictions.

- High level of trust from banks and partners thanks to corporate tax and ESR.

- Prestigious legal form that strengthens the company’s reputation internationally.

➖ Cons:

- Mandatory expenses for office space and staff to comply with ESR.

- Taxation (corporate tax) increases the cost of doing business.

- The administrative burden is higher than for companies in FEZs or offshore zones.

How to open a holding company in the UAE: step-by-step instructions

Registering a holding company in the Emirates is a process that requires precise decisions and knowledge of local legislation. We describe the universal steps for all companies in the UAE, but in each section we provide one specific example to illustrate the actual terms and requirements. This approach helps to see how complex the procedure is and why it is best to go through it with experts.

- Determining the format and jurisdiction

- Determining the ownership model

- Preparation of documentation

- Registration of the holding company

- Opening a bank account

Determining the format and jurisdiction

There are three formats available for registration in the UAE: mainland company, free zone, and offshore. The choice depends on the objectives: ownership of assets in the country, international settlements, tax optimisation, or reputation for banks.

- The mainland format gives you the right to directly own real estate and shares in local companies, but requires compliance with corporate tax and ESR.

- Free zones offer flexibility in terms of licences and simplified conditions, but are limited in terms of territory.

- Offshore is suitable for international structures, but does not allow you to own assets within the UAE.

Example request:

The owner comes with a question — how to set up a holding company quickly and at minimal cost, while still being able to open a bank account in the UAE and invest in a local company in the future. At first glance, it seems that choosing an offshore company is sufficient. However, during the consultation stage, it becomes clear that this does not give the right to own property in the Emirates, banks require an extended KYC package, and the documents of all directors must be certified and apostilled.

Solution:

We suggest starting with registering the holding company in IFZA or Meydan for international assets, where the documentation requirements are simpler than in other offshore jurisdictions. At the same time, we immediately envisage the possibility of creating an additional structure on the mainland or in the Dubai Free Zone, which allows you to invest in local companies and own real estate. This approach saves time and money, but provides flexibility for future projects.

Determining the ownership model

After choosing the jurisdiction, the owner needs to decide how the assets will be owned. This is where contradictions often arise: the holding company should be simple and transparent for banks, but at the same time flexible for future investments.

Options:

- The holding company may directly own shares in foreign companies.

- Ownership may be organised through intermediate companies created specifically for certain assets.

- A combined model is also possible, where intellectual property and trademarks are separated into a separate structure.

Example request:

The owner plans to contribute shares in two foreign companies and trademark rights to the holding company. It seems that it would be sufficient to contribute the assets directly, but the banks require an organisational chart, the registrar requests a description of the sources of funds, and the transfer of intellectual property rights has tax implications.

Resolution of the request:

After consultation, we suggest registering a holding company as the main structure and creating a separate enterprise to manage intellectual property rights in order to reduce risks and simplify bank checks.

Preparation of documentation

After selecting the ownership model, you need to collect a package of documents for registering the holding company. At this stage, it is important to take into account the requirements of the specific jurisdiction: the registrar verifies the identity of the owner, the sources of funds and the legal purity of the assets.

Differences between jurisdictions:

- RAK ICC: requires a passport, proof of address, bank reference, description of sources of funds and corporate documents for companies that will be included in the holding. All documents must be translated into English and notarised.

- DMCC: additionally requests a business plan and organisational chart to confirm the transparency of the structure.

- ADGM: may require financial statements for previous periods and confirmation of the owner’s tax residency.

Example situation:

After reading articles on the internet, clients often believe that a basic set of documents – a passport, founding documents and proof of address – is sufficient to register a holding company. But then they encounter delays and refusals. After all, no article can replace quality advice.

Solution:

We analyse the chosen jurisdiction, compile a complete checklist of documents and synchronise the requirements of the registrar and the bank. This approach allows you to pass the verification without unnecessary risks and reduce the registration time.

Registration of the holding company

At this stage, the company is officially entered into the register, which records data on owners, beneficiaries, and key parameters of activity. After that, the holding company obtains the right to own assets and operate in the chosen format.

The procedure includes:

- Approval of the name. This includes checking the uniqueness of the name and its compliance with the rules of the jurisdiction.

- Submission of an application for registration. The application specifies: the type of activity, ownership structure, details of the director and other participants.

- Provision of information about beneficiaries. The registration authority requests a passport, proof of address and a description of the sources of funds.

- Approval of statutory documents. The articles of association specify the holding function of the company and restrictions on its operational activities.

- Payment of fees and incorporation. After paying the state fees, the company is entered in the Register and receives registration documents and a licence.

Usually, registering a holding company takes 5–15 business days when submitting a complete package, without any clarifications from the registrar.

Example request:

During a consultation, the owner asks whether it is possible to register a holding company in the UAE with a basic holding licence. This would allow the company to have a stake in foreign businesses, receive dividends, and redistribute funds within the group.

Solution:

During the consultation, we explain that the wording of the licence and articles of association directly affects the holding company’s capabilities. If the description of the licence’s activities is too narrow, restrictions on financial transactions within the group may arise. We show which wording allows you to retain control over assets and the movement of funds without the need to change the licence or structure in the future.

Opening a bank account

After registering the holding company, the next step is to open a corporate bank account in the UAE. At this stage, financial institutions assess not only the company, but also the ownership structure, the purpose of the holding company and the economic logic of its operations.

Particular attention is paid to the purpose of the account, the sources of funds, the countries where subsidiaries are located, and the role of the holding company within the group. Even in the absence of operational activities, a clear explanation of financial flows is required: where the funds come from and how they are used within the structure.

The right choice of bank, filling out the application form and providing accurate information directly affect the timing and likelihood of opening an account. This process is described in detail in a separate article.

Example situation:

Registering a holding company in Dubai requires opening a bank account.

And it is this stage that often becomes crucial — banks impose various requirements on the structure, documents, and transparency of the business.

Solution: When clients come to us for a turnkey service, we immediately explain that banks in the UAE work with holding structures in different ways and recommend options where the probability of opening an account is higher. For example, Emirates NBD is more typically suitable for holding companies with a transparent structure and clear dividend flows, Mashreq, for groups with international assets and regular intra-group transactions, and RAKBANK is often considered for more compact structures without a complex investment profile.

Where is the best place to open a holding company in the UAE?

When you are planning to register a holding company, it is important to determine the jurisdiction right away, as this will determine the company’s capabilities.

- RAK ICC (offshore) – ideal for international assets, tax optimisation, and convenient ownership of foreign projects. Not suitable for doing business within the UAE..

- Mainland (mainland company) – chosen for owning local assets, participating in business within the country, and obtaining licences.

- Free Zones (e.g. DMCC, IFZA) – suitable for international trade, holding structures with operational activities, and convenient opening of bank accounts.

- DIFC and ADGM (financial centres) – used for large funds, investment structures, and international groups with transparency and regulatory requirements.

The right choice of jurisdiction affects the holding company’s development prospects. It determines whether the company will be able to open a bank account without unnecessary delays, what tax regimes will apply, how easy it will be to manage international assets and conclude agreements with foreign partners. We clarify all these issues during the consultation.

Structure of a holding company in the UAE

A holding company in the UAE is built around a simple but formally verified management structure. Requirements may vary slightly across jurisdictions, but the basic logic for holding companies is similar across the country.

- Owner. Can be a natural person or a legal entity. In most free zones, 100% foreign ownership is permitted. The number of shareholders varies from one to several, depending on the jurisdiction.

- Director. At least one director is required to establish a holding company. In a number of zones, the director and shareholder may be the same person. The director is responsible for strategic management and signing corporate documents.

- Secretary. In mainland jurisdictions and most free zones, a secretary is not required. However, in DIFC and ADGM, a secretary is required. But this function can be performed by a director or a specialised provider.

- Office. Each company must have a registered address in the UAE. For offshore structures (e.g., RAK ICC), the address of the registration agent is sufficient. For mainland and free zones, a physical office or flex-desk is required.

- Management and corporate procedures. The holding company is managed through the decisions of the owner and director. Formally, corporate documentation must be maintained: decisions, minutes, register of participants and directors. These documents are kept within the company and provided upon request by regulators or banks.

- Reporting. From 2023, holding companies are required to keep accounting records and retain records for at least 5 years. Depending on the jurisdiction and structure, an independent financial audit may be required. Even in the absence of operational activity, it is necessary to reflect cash flows, dividends and asset ownership in the reports.

- Banking. A holding company may open a corporate account with banks in the UAE, but their choice depends on the transparency of the structure and nature of the assets. Banks require disclosure of ultimate beneficial owners (UBOs) and confirmation of the sources of funds.

This model allows for centralised asset management without excessive administrative requirements. At the same time, the roles of owner and director, as well as corporate procedures, must comply with UAE requirements.

How much does it cost to set up a holding company in the UAE?

The cost of setting up a holding company in Dubai depends on the structure and level of support. In fact, clients choose a format in which one team takes care of the key stages — this saves time and reduces risks.

Turnkey registration of a holding company

For standard holding companies without operational activities, the cost starts at USD 9,000–12,000. This amount includes the selection of a jurisdiction, setting up the structure, preparing documents, and full registration support. Simpler options without extended support, such as ‘registering a holding company offshore,’ will cost between USD 5,000 and USD 7,000.

Additional services

Depending on the task, the following may be required:

- nominee services (director or shareholder);

- notarisation and legalisation of documents;

- assistance in opening a corporate account in the UAE;

- legal and accounting support after registration.

Conclusion

A holding company in the UAE is a tool that sets the logic for asset management for years to come. The convenience of operation and opportunities for further business development depend on how the structure is built, how activities are formulated, and how a banking partner is chosen.

In practice, most difficulties arise not because of the rules themselves, but because of nuances that are not always apparent at the outset: the wording of the licence, the requirements of specific banks, the specifics of taxation and corporate roles. These are the factors that influence how flexible and predictable the holding structure will be.

If you are planning to register an international holding company or want to check the model you have already chosen, sign up for a consultation with Dynasty Business Advisors. We will help you understand the details, offer the best solution and, if necessary, take care of the key stages — so that the structure works stably and supports business growth.

Start with a consultation and get a clear understanding of which holding model is right for you.