What are the advantages of registering an offshore company in the UAE?

An offshore company registered in the Emirates has several advantages that make its opening beneficial for businessmen from other countries. Let’s take a look at the benefits:

- Possibility of owning 100% foreign capital. At the same time, registration of a local onshore company operating in the oil, gas, banking, hotel, and insurance sectors requires a partner – a UAE citizen owning 51% of the shares;

- Exemption from customs duties and almost all taxes, under certain conditions;

- Lack of government control over foreign exchange transactions and restrictions on capital repatriation;

- Lower cost of registration compared to onshore companies in free zones and local companies opened outside them;

- Minimum requirements for the authorized capital, the number of shareholders and directors when opening a company, as well as its rapid registration of an offshore company in the UAE;

- Complete confidentiality of the company’s activities, and information about its beneficiaries and directors. The reason is that the UAE is not a member of the OECD, so it does not share information with the tax departments of other countries, and the register of offshore companies registered in the UAE is non-public;

- The right to open an offshore account in any bank in a country whose banking system is distinguished by reliability, security, and low cost of services, as well as abroad.

An offshore company in the Emirates may have its own characteristics, depending on the free economic zone where it is registered.

Offshore in Dubai, Jebel Ali Free Zone

Jebel Ali is one of the largest free zones in Dubai, which was founded back in 1985, and today occupies an area of 40 square kilometers. JAFZA’s main advantage is access to major international transport hubs. There is the navigable seaport of Jebel Ali on the territory, one of the largest in the world, and Al Maktoum Airport.

The features of offshore companies in the Jebel Ali Free Zone include:

- minimum number of shareholders – 1;

- mandatory presence of at least 1 director (can be a citizen of any country);

- higher cost of registration compared to SEZs in the emirates of Ajman and Ras al-Khaimah;

- the presence of requirements for accounting and storage of all accounting records for 10 years, in the absence of requirements for mandatory reporting and auditing;

- the opportunity to purchase real estate in Dubai, which is not allowed for all resident companies and only with a special permit or license;

- The time it takes to register a company is 1-2 weeks, while in other free zones, you can register an offshore company in just 1-3 days.

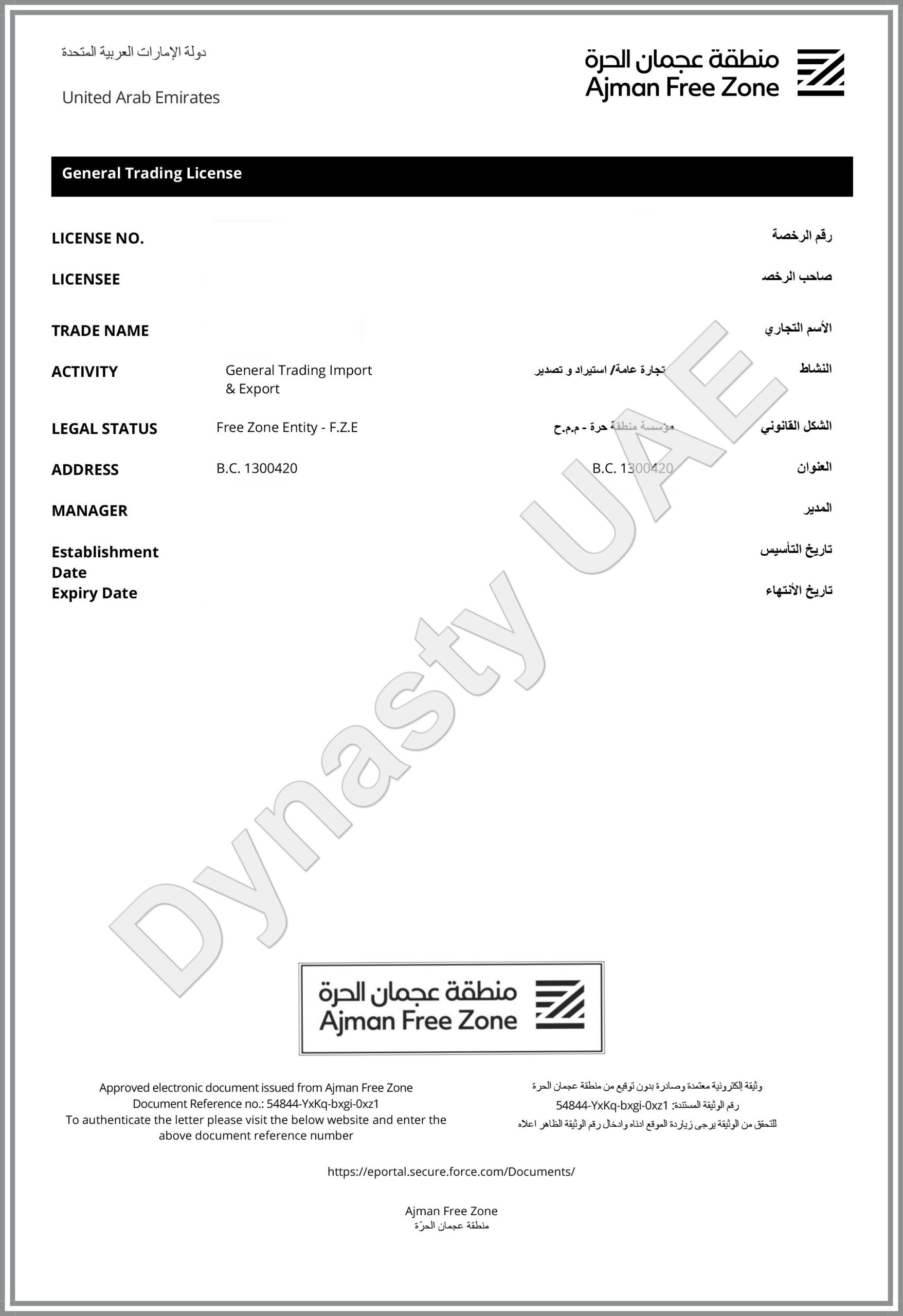

Offshore in Ajman Free Zone (Emirates)

Located on the shores of the Persian Gulf in the emirate of Ajman, AFZ was founded in 1988. It is located 35 km from Dubai, close to four major shipping ports and two international airports. The opening of offshore companies here began in 2014.

The main advantages of opening an offshore company in the UAE in the Ajman Free Zone:

- the possibility of registration by both an individual and a legal entity (except for trusts and private foundations);

- low cost of registration;

- the ability to register a company in 1-2 days;

- lack of requirements for accounting, reporting, and auditing;

- quick opening of an offshore bank account;

To open an offshore company in the Ajman Free Zone, the personal presence of the founder is not required.

UAE offshore company in RAK Investment Authority Free Zone

SEZ RAK Investment Authority, founded in 2005 in the emirate of Ras al-Khaimah, is located in the north of the UAE, 45 minutes from Dubai, close to three international airports and three shipping ports. For offshore companies in this free zone, the following are provided:

- the possibility of registration by both an individual and a legal entity (except for trusts and private foundations);

- lower registration price compared to an offshore company in Dubai;

- quick registration procedure – within 1-3 days and without the personal presence of the shareholder;

- mandatory presence of an authorized capital in the amount of at least 1000 AED, which is approximately equal to $275, and the deadline for its payment is not established;

- presence of requirements for maintaining accounting records in the absence of the obligation to submit reports to government bodies. All accounting records must be retained for the directors of the company to determine its financial position;

- the opportunity to purchase real estate in the emirates of Ras al-Khaimah and Ajman.

The registration of offshore companies in the RAKIA free zone is handled by the RAK International Corporate Center (RAK ICC), a structure specially created in 2015.

|

Offshore zones |

Registration cost |

|---|---|

|

Ajman offshore |

The minimum is 6,000 dirhams |

|

Jafza offshore |

The minimum is 15,000 dirhams |

Restrictions for offshore companies in Dubai and other emirates

Regardless of the free-zone in which an offshore company is registered in the UAE, it is subject to certain restrictions. Offshore companies in the UAE are prohibited from:

- conducting any activity in the country – an offshore company can engage in international trade and management of sea vessels, holding and consulting (except for the Jebel Ali free zone) activities, or providing professional services outside the UAE;

- cooperating with legal entities registered in the Emirates and receiving bank transfers from them. At the same time, an offshore UAE company can be a founder of local and foreign companies, companies in the free zone, or acquire their shares;

- renting a real (physical) office in the country;

- applying for a UAE resident visa;

- engaging in financial, media, and aviation activities, working with precious metals, gas, and oil.

All these restrictions must be taken into account if you are going to open an offshore company in the UAE.

Taxation of offshore companies in the Emirates

Since offshore companies registered in Jebel Ali, RAKIA, and AFZ free zones of the United Arab Emirates are not residents of the country, they are exempt from paying almost all taxes. The 0% rate is set for offshore companies, provided that the managing person of the company is located outside the UAE.

However, such firms will have to pay an annual registration renewal fee and pay for the services of a registered agent, which every offshore company must have in order to be registered and renew the registration.

The procedure for registering an offshore company in the UAE

To register an offshore company in the Emirates, you must adhere to the following procedure:

- choose a registration agent licensed to register offshore companies – this person will lead the entire process of opening your company and annually renew its registration. Dynasty Business Adviser is the licensed registrar of offshore companies in the UAE;

- choose a suitable offshore jurisdiction – your agent will tell you which of the three free zones is more suitable in terms of doing business, cost, and registration conditions, as well as taking into account other factors;

- decide on the type of activity and choose the name of the company, and the registration agent will reserve it for you (the name should not coincide with the name of other offshore companies in the registry);

- prepare the documents necessary for registration (their list is established by the governing body of the free zone), translate them into Arabic or English, legalize copies, and notarize translation in the prescribed manner. Since the UAE is not a party to the 1961 Hague Convention, consular legalization will be required;

- submit an application for company registration, attach a package of documents, pay the registration fee and agent services;

- obtain a certificate of registration of an offshore company and other registration documents (charter, licenses, and share certificate).

After receiving the registration documents, you can apply to open an offshore account.

The time frame for opening an offshore company in the Emirates

To open an offshore company in Dubai, Ras Al Khaimah, or Ajman, it will take time to prepare documents and register. The registration itself, depending on the chosen offshore jurisdiction, takes from 1-2 days to 1-2 weeks, but the translation of documents and their legalization will take much more time. After all, to legalize your documents, you need to be certified first in the country of issue, and then in the Ministry of Foreign Affairs of the United Arab Emirates.

In your country, you certify the following:

- copies of documents and their translation (from a notary);

- stamp and signature of a notary (at the Ministry of Justice);

- the seal of the Ministry of Justice and the signature of an official (in the Consular Department of the Ministry of Foreign Affairs);

- the seal of the Ministry of Foreign Affairs and the signature of the official (at the UAE consulate).

Understandably, all these procedures take time, from 4-5 working days to two weeks.

Documents required to open an offshore company in the UAE

To apply for registration of an offshore UAE company, individual shareholders need to submit the following documents:

- data on the company structure and activities;

- copies of the civil passports of each founder and director;

- documents confirming the residential address of each director and shareholder (utility receipt with the residential address and full name indicated on it);

- a short resume for each shareholder containing information about education, recent places of work, and positions held;

- a letter of recommendation (original) for each founder of the company from the bank where he has been serviced for more than a year, stating that he is recommended as a reliable partner.

After reviewing this package, the FEZ management may request additional documents.

If there is a legal entity among the founders, the package of documents submitted for offshore registration must include:

- duly legalized corporate documents of the parent company;

- a statement of the decision of the company’s governing body, for example, the board of directors, on its intention to become a shareholder of an offshore company;

- a letter of recommendation from the bank servicing the company and a statement of the flow of funds in its corporate account;

- a certificate of absence of debts on taxes and fees;

- documents of the directors of the company confirming their identity and place of residence.

Bank account for offshore in the UAE

To conduct business, an offshore company requires a bank account. It can be opened in one of the banks operating in the United Arab Emirates or outside the country. Although not all local banks accept offshore accounts, there are reliable banking institutions in the country that provide the opportunity to open and service such accounts.

If you are interested in registering an offshore company in the UAE, contact Dynasty Business Adviser! We will help you open an offshore company in the shortest possible time, saving time and money.

Conclusion

Offshore registration in the UAE opens up new horizons for business activities. The main advantages of such a resolution are:

- the possibility of opening an offshore account with any of the reliable Emirates banks;

- absence of state control over currency transactions;

- 100% confidentiality of personal data of the owners of the company and the specifics of its activities (the Arab Emirates is not a member of the OECD);

- no taxes (0% rate only for managing persons located outside the country);

- registration of offshore companies is characterized by a quick procedure and minimal financial investments compared to the establishment of onshore companies.

For example, opening an offshore in the UAE in Jebel Ali, Ajman Free Zone and RAKIA can be done in just 4-14 working days. The capital investment of a business owner at this stage starts from 6000 AED.

To open a turnkey offshore company, seek assistance from the qualified specialists of Dynasty Business Adviser. Also, if you are wondering how an offshore company in Dubai, Ajman or Ras Al Khaimah will function, get comprehensive advice from a licensed registrar. To do this, fill in the form below or contact us in any other suitable way.

Get advice

Manager

Consultant

Lawyer

Manager

Manager (PRO)

Manager