There are three ways to establish a company in the UAE: registering a new business, opening a branch or representative office of an existing company, or purchasing a ready-made business. Companies can be established in various jurisdictions — on the mainland, in free economic zones (FEZs), or in special (offshore) zones.

Sounds complicated? Perhaps, especially when you consider that tax regimes, registration requirements, and visa support vary in each case. Nevertheless, the advantages are well worth the effort of exploring the subject in greater depth.

Advantages of Registering a Company in the UAE

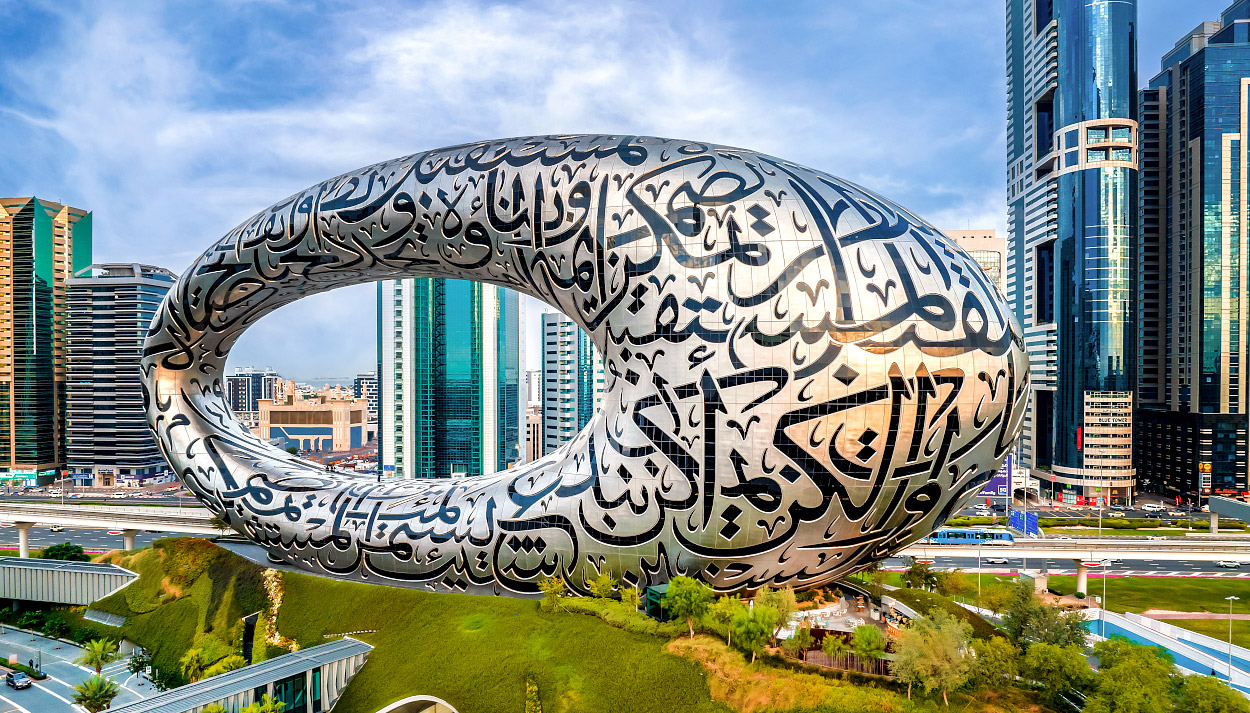

The UAE economy is reliable and stable. The government actively seeks to reduce its dependence on natural resources and therefore encourages businesses outside the oil and gas sector. Under this policy, setting up a company in Dubai is a genuinely forward-looking decision.

Taxes and Ownership

- 9% corporate tax — applies only to profits exceeding AED 375,000.

- 5% VAT — four times lower than in the UK.

- 0% tax on dividends — profits can be repatriated without additional charges.

- 0% capital gains tax — investments are not taxed.

- 0% import and export duties — freedom of international trade.

- Double taxation treaties with 138 countries — protection against being taxed twice.

- Over 50 free zones offering simplified registration and preferential regimes.

- 100% foreign ownership — no local partner required.

The UAE as a Business Jurisdiction

- Residency — visas of up to 10 years, renewable, available to entrepreneurs and their families.

- Strategic location — ideal geography for global business operations.

- Infrastructure — modern cities, advanced digitalisation, and a high standard of living and business comfort.

- Currency operations — unrestricted repatriation of profits and capital.

- Banking system — high levels of reliability and asset protection.

- Confidentiality — account holder information is protected by law.

- Support for small businesses — monopolistic practices are actively restrained.

- Safety — one of the highest safety indices in the world: 83.4 (2024).

Requirements for Setting Up a Company in the UAE

Investors planning to register a company in the UAE must meet some requirements:

- Obtain a business licence. This document is issued by the General Directorate of Residency and Foreigners Affairs. Certain activities also require approval from the relevant ministries or regulatory bodies.

- Prepare the constitutional documents. Prepare the statutory documents. At least one director and one shareholder must be specified, with a maximum of 50 people.

- Appoint a registered (corporate) agent. The agent represents the company before the authorities of the chosen emirate.

- Provide a registered address. An address in one of the emirates must be secured through the purchase or lease of an office, warehouse, or a virtual office (available in free zones).

- From the share capital. The required amount depends on the company type and jurisdiction. In some free zones, paid-up capital is not mandatory.

- Submit annual financial statements. This requirement applies to all registered companies, regardless of their level of income.

- Hold shareholders’ meetings. Meetings are mandatory irrespective of the ownership structure; however, they may be held remotely.

Requirements vary across different emirates and free zones, so registering a company independently can take months. Dynasty Business Adviser helps you select the most suitable jurisdiction for your business and provides end-to-end support throughout the registration process.

Choosing the Legal Structure of a Business

In the UAE, a company’s legal structure has a direct impact on its operational scope, obligations and regulatory environment. It determines where and how you can conduct business, which taxes apply, who may act as shareholders, and which licences are required.

Why does this matter?

- Jurisdiction sets the rules of the game. Each emirate and free zone has its own requirements regarding company structure, minimum share capital, permitted activities and reporting standards.

- The legal form affects market access. Some zones are geared towards international trade, while others focus on the local market. Your choice determines whether you can work with UAE residents, hire staff locally and open physical offices.

- Different tax burdens and reporting obligations. Certain jurisdictions offer tax incentives, while others require complete financial reporting and mandatory audits.

- Ownership and management restrictions. Some legal forms require a local partner or agent, whereas others allow 100% foreign ownership.

Choosing the proper legal structure at the outset helps avoid regulatory limitations and ensures your business can operate efficiently as it grows.

What Does the Choice Involve?

- Jurisdiction — an emirate, an offshore jurisdiction, or a free zone.

- Company type — LLC, Free Zone Company, Offshore Company, and others.

- Business activity — trading, services, manufacturing, finance, etc.

- Licensing and share capital requirements.

- Ability to operate within the UAE or internationally only.

The experts at Dynasty Business Adviser will help you select the most suitable legal structure and jurisdiction based on your business objectives, budget and scalability requirements.

Comparison of UAE Jurisdictions

Setting up a company in the UAE is possible in one of three jurisdictions: the mainland (Mainland Company), a free economic zone (Free Zone Company), or an offshore jurisdiction (Offshore Company). Each option offers its own company formats, regulatory framework and operational opportunities. An incorrect choice at this stage may significantly limit your business growth.

Below is a table outlining the key differences, advantages and limitations of each model.

| Criterion |

Mainland Company |

Free zone Company |

Offshore Company |

|---|---|---|---|

|

Registration |

Through the Department of Economic Development (DED) |

In one of 40+ free economic zones |

Via an offshore registrar (RAK ICC, JAFZA, Ajman) |

| Ownership | Up to 100% foreign ownership (depending on the activity) |

100% foreign ownership with no restrictions |

100% foreign ownership, no local partner required |

| Doing business in the UAE |

No restrictions — permitted to operate across the entire country |

Limited to the free zone or via a local distributor |

Not permitted — activities allowed only outside the UAE |

| Permitted activities |

Any activities permitted by law |

Limited to the licence list of the specific free zone |

International trade, consulting, holding structures, investments |

| Office requirement |

A physical office is mandatory |

Depends on the free zone (virtual offices may be available) |

No office required |

| Taxes |

Since 2023 — 9% corporate tax |

Often tax-exempt, subject to the zone and turnover |

Full tax exemption if no income is generated within the UAE |

| Visas and residency |

No formal limits; depends on office size |

Limited (usually up to 6–7 visas), depending on the zone |

Visas are not available |

| Purpose of registration |

Operating in the local market, participating in tenders, scaling within the UAE |

Export, online services, international operations |

Asset protection, tax optimisation, global investment structures |

| Best suited for |

Corporations, retail chains, companies with a local operational model |

Start-ups, SMEs, IT, logistics, media, consulting |

Investors, holding companies, international structures with no UAE operations |

Types of Companies You Can Set Up in the UAE

The UAE offers several types of business structures. The main types include a branch, a local (mainland) company, an offshore company, and an onshore company. Some formats are designed for operating within the local market, while others are suitable exclusively for international activities. Below is a detailed overview of each option.

A branch is an extension of a foreign company that operates in the UAE on behalf of its head office and is dependent on its structure and decisions. This format is suitable for businesses that wish to operate officially in the region without establishing a new legal entity.

A branch is permitted to conduct business, generate revenue and enter into contracts; however, all legal liabilities remain with the parent company. Registration requires obtaining a licence, securing office premises and appointing a local service agent.

When opening a bank account, a refundable security deposit may be required as a safeguard against potential regulatory breaches. This requirement does not apply to branches registered in free economic zones.

Step-by-step guide to opening a branchA mainland, or local, company is a legal entity registered on the mainland of the UAE. A local or domestic company is a legal entity registered in the mainland part of the Emirates. It can operate throughout this country, including working with government agencies.

Some licences require the participation of a UAE national who officially owns 51% of the company’s shares. In practice, this is usually a nominal agreement, with complete operational control remaining with the foreign investor. Nevertheless, selecting a reliable local partner is essential.

A mainland company is the right choice for businesses planning to operate in the domestic market, open physical outlets, participate in tenders, or hire staff without restrictions.

Find Out More About Mainland CompaniesAn onshore company in a free zone is a legal entity registered in one of the UAE’s free economic zones (FEZs). Each free zone has its own registering authority, with its own set of licences and business regulations. While the rules vary, free zones share several key advantages: 100% foreign ownership, tax incentives, fast registration timelines and the option to complete the process remotely.

Such a company may lease a virtual office, hire staff and open a corporate bank account. However, it cannot trade directly with the UAE domestic market — doing so requires a local intermediary or an additional licence.

This structure is well-suited to businesses involved in exports, online activities, or those looking to launch a project quickly with minimal costs.

All registration detailsAn offshore company is a legal entity registered in one of the UAE’s offshore jurisdictions, such as JAFZA or RAK ICC. This type of company is not permitted to conduct business within the UAE or deal with UAE residents. However, it may hold assets, carry out international transactions, protect capital and optimise tax exposure.

An offshore company typically does not require a physical office, is not subject to audit requirements and is exempt from corporate tax. Shareholders may be foreign nationals, and the entire registration process can be completed remotely.

This structure is suitable for holding companies, real estate ownership, intellectual property management or participation in overseas projects. That is an ideal solution for those who do not intend to conduct commercial activities in the UAE but wish to utilise the jurisdiction for international purposes.

Registration detailsAvailability of Company Types Across UAE Jurisdictions

Not all company structures described above can be registered in every jurisdiction. The UAE has three main jurisdictions: the mainland, free economic zones, and offshore jurisdictions. The table below shows the types of companies that can be established in each jurisdiction.

| Mainland Jurisdiction |

Free Economic Zones |

Offshore Jurisdiction |

|---|---|---|

|

Limited Liability Company (LLC), Sole Proprietorship, Civil Company, Public Joint Stock Company (PJSC), Private Joint Stock Company (PrJSC), Branch of a Foreign Company, Representative Office |

Free Zone Establishment (FZE), Free Zone Company (FZCO), Branch of a Foreign Company, Freelance Licence, Holding Company, Special Purpose Vehicle (SPV) |

International Business Company (IBC), Holding Company, Special Purpose Vehicle (SPV) |

How to Open a Company in the UAE?

Before establishing a company in the UAE, it is necessary to select the appropriate jurisdiction and legal form. Consider whether your business will operate in the local or international market, whether you plan to participate in government programmes, and whether you intend to hire local staff. Once these decisions are made, you can move on to the following stages.

- Preparation for registration

- Registration process

- Completion of registration

Preparation for Registration

The first step is to select your business activity. The UAE offers more than 2,000 permitted activities, each linked to a specific type of licence. You will then need to prepare a business plan and choose a company name that complies with local naming regulations.

The founders’ documents must be compiled into a complete set and legalised. After that, the registrar will review and reserve the company name. Much of the preparatory work can be completed remotely, particularly when registering a company in a free zone.

Registration Process

You begin by submitting an application and awaiting preliminary approval. Once approved, the company’s statutory documents are prepared and, where required, the share capital is formed. In some cases, a physical office is required to open a company in the UAE. It must be rented or purchased in advance.

After the government fees are paid and the complete set of documents is submitted, you receive the Certificate of Incorporation. At the same stage, the business licence for the chosen activity is issued.

Completion of Registration

Following registration, the company is issued an Establishment Card, which confirms its registration with the immigration authorities. You then need to open a corporate bank account, a process that may take from several days to a couple of weeks.

The final stage includes setting up payment systems, registering for tax reporting and arranging visas for employees. Finally, the company can fully operate and generate profit.

Opening a Corporate Bank Account in the UAE

To operate successfully after company formation in the UAE, a corporate bank account is essential. The account opening process includes selecting a bank, obtaining preliminary approval from its compliance department, the personal presence of a director or shareholder, completion of due diligence checks (KYC/AML), and payment of an initial deposit (typically from AED 50,000).

Why Choosing the Right Bank Matters

Banks in the UAE differ in the depth of their compliance checks, the speed at which applications are processed, and their willingness to work with foreign-owned companies. Some institutions focus on large corporations, while others are more oriented towards start-ups and international IT businesses. Certain banks also issue international debit cards, allowing clients to make payments without undergoing currency control procedures.

In practice, the following institutions have proven to be reliable and well-established:

- Emirates NBD — one of the UAE’s largest banks, with a strong track record of opening accounts for corporate clients,

- Mashreq — actively works with international companies, including IT and online businesses,

- ADCB — a reliable bank with a transparent compliance process and strong support for small businesses.

To confirm which documents are required in your specific case, you can clarify the details with our managers during an initial consultation.

Documents and Conditions for Opening a Bank Account in the UAE

Minimum set of documents:

- Passports and residency visas of the shareholders;

- Company registration and incorporation documents;

- A description of the business activities and corporate structureя;

- A business plan for newly established companies,

- Financial statements for branches and representative offices;

- Bank statements from the shareholders’ personal accounts.

Key procedural considerations:

- Banks conduct thorough checks on the source of funds and the business model;

- Offshore and free zone companies are subject to enhanced due diligence;

- Owning or leasing office premises, having preliminary agreements with potential partners, and a clearly differentiated business concept can significantly increase the likelihood of approval;

- Account opening may be declined without explanation.

How to Increase Your Chances of Opening a Bank Account?

Banks in the UAE take a highly risk-based approach, applying strict client requirements, thoroughly verifying sources of funds and maintaining internal watchlists. To complete the procedure for opening a bank account in the UAE, it is highly recommended to work with specialists.

An experienced agent takes all key factors into account: analysing the company profile, selecting the most suitable bank and ensuring that documents are submitted correctly. As professionals, we do not simply increase your chances — we ensure that an account is successfully opened.

Documents Required to Register a Company in the UAE

Errors in documentation during registration can significantly delay the company formation process in the UAE.

One common mistake is attempting to prepare a “universal” set of documents. In practice, different jurisdictions have various regulatory bodies, each requiring its own specific set of documents. To clarify the situation, we have provided a list of the necessary documents for different types of companies in the table below.

| Company Type |

Core Documents |

Notes |

|---|---|---|

|

Free Zone |

– Shareholder’s passport. – Passport photo on a white background. – CV. – Business activity plan. – Proof of residential address. |

Requirements vary by free zone — for example, DMCC may request a more detailed business plan. |

|

Mainland |

– Passport and visa of the shareholder. – Emirates ID (if available). – Memorandum of Association (MOA). – Office lease agreement (Ejari). – Business licence. |

Registration is carried out through the Department of Economic Development; physical office lease and a local sponsor may be required. |

|

Offshore |

– Shareholder’s passport. – Proof of address. – Bank reference letter. – CV. – Corporate structure (if holding entities are involved). |

Commonly used for holding and international operations; documents are submitted via a registered agent. |

Key Points to Consider?

- There is no single, universal list of documents — requirements may vary from one free zone to another.

- The required documentation depends on your business activity. Trading, consulting and IT businesses require different licences and, in some cases, different legal structures.

- Some free zones require personal presence, while others allow the entire registration process to be completed remotely.

How to Legalise Corporate Documents — and Why It Is Necessary?

In 1961, more than 100 countries adopted the Hague Convention, which introduced a simplified form of international document certification known as an apostille. An apostille allows official documents to be used abroad without additional legalisation.

However, the UAE is not a party to the Hague Convention, which means that apostilles are not recognised in the country. As a result, any documents issued outside the UAE must undergo a legalisation procedure through the UAE consulate and the Ministry of Foreign Affairs.

* Legalisation is the process of confirming the authenticity of a document so that it has full legal force within the UAE.

Documents Requiring Legalisation

If the founder of the company is a foreign individual or legal entity, it is necessary to legalise:

- Constituent documents of the foreign company (Certificate of Incorporation, Articles / Memorandum of Association).

- Power of Attorney issued to a representative in the UAE.

- Passports of shareholders and directors.

- Board resolutions approving the company’s set-up in the UAE.

- Any other official documents issued outside the UAE and submitted to registrars or banks.

The exact list depends on the company type, jurisdiction and business activity. You can clarify which documents are required in your case with our company managers during the initial consultation.

Legalisation Procedure for Documents

The legalisation process generally includes the following steps:

- Notarisation of the document in the country of origin

- Certification by the Ministry of Foreign Affairs of the issuing country.

- Certification by the UAE Embassy or Consulate in the country of origin.

- Final certification by the Ministry of Foreign Affairs of the UAE.

- Translation into Arabic and notarisation of the translated document.

Consequences of Failing to Legalise Documents

- The documents will not be accepted by the registration authorities.

- Company registration may be suspended or rejected.

- Banks may refuse to open a corporate account.

- The process will take weeks, with additional costs for corrections.

Cost of Company Formation in the UAE

The final cost of setting up a business in the UAE depends on several factors, including the type of licence, jurisdiction, number of residency visas, office rental, and additional services provided by agents or notaries.

On average, company registration costs are as follows:

- In the free zone, with a single visa from $4,000 to $7,000.

- Mainland company — from $12,000.

- Offshore company — from $3,000.

If you require turnkey company formation in the UAE, you should also factor in the agent’s fees, which typically range from $1,000 to $2,500, depending on the scope of support.

The total price is influenced by the licence type (Trading, Service, Premium, etc.), the number of residency visas, the availability of a workspace (Flexi Desk), and the chosen free economic zone. Below, we outline sample packages for popular jurisdictions such as IFZA (Dubai) and UAQ Free Zone (Umm Al Quwain).

Company Registration Costs by Licence Type and Number of Visas

The table below shows the cost of standard registration packages in IFZA (Dubai). These packages include a Trading or Service licence, a virtual workspace (Flexi Desk), and the issuance of residency visas.

IFZA (Dubai): Licence Packages and Visa Options

|

Licence Type |

Flexi Desk |

Number of Visas |

What’s Included |

AED |

USD |

|---|---|---|---|---|---|

|

Trading or Service |

Included |

0 |

Licence, Flexi |

12 900 |

3,540 |

|

Trading or Service |

Included |

1 |

Licence, Flexi Desk, 1 residency visa виза |

16 900 |

4,630 |

|

Trading or Service |

Included |

2 |

Licence, Flexi Desk, 2 residency visas |

18 900 |

5,180 |

Cost of Company Registration with a Basic Licence

The table below shows the cost of company registration in the Umm Al Quwain Free Zone (UAQ Free Zone) with one of the three basic licences: Trading, Service, or E-commerce. All packages include a virtual workspace (Flexi Desk) and differ by the number of residency visas included.

UAQ Free Zone: Company Registration Packages

|

Licence Type |

Workspace (Flexi Desk) |

Number of Visas |

AED |

USD |

|---|---|---|---|---|

|

Trading / Service / E-commerce |

Included |

0 |

8 000 |

2,200 |

|

Trading / Service / E-commerce |

Included |

1 |

15 000 |

4,110 |

|

Trading / Service / E-commerce |

Included |

2 |

22 000 |

6,030 |

Service Licences in the UAE

The table below allows you to compare service licences in the UAE by licence type, visa availability, permitted activities and indicative pricing. These licences are suitable for freelancers, agencies, consulting firms and IT businesses. Prices are approximate and depend on the free zone and the specific package selected.

|

Zone / Region |

Licence Type |

Visa |

Permitted Activities |

Cost (AED) |

Notes |

|---|---|---|---|---|---|

|

IFZA (Dubai) |

Service License |

1 |

Consulting, IT, marketing |

14900 |

Includes one visa and a Flexi Desk |

|

RAKEZ (Ras Al Khaimah) |

Consultancy License |

1 |

B2B services, training |

13500–16000 |

Fast, remote registration |

|

UAQ Free Zone |

Premium Service License |

1 |

Services, consulting |

21000 |

Up to 10 activities, visa included |

|

Dubai Mainland |

Professional License |

1+ |

Services with a physical office |

from 15,000 |

Local service agent required |

|

SHAMS (Sharjah) |

Media / Service License |

0–1 |

Design, advertising, IT |

5750–11500 |

Lower cost, but limited options |

Premium and General Licences

Some registration options are more expensive because they include a broader range of mandatory costs. For example, a trading licence in DMCC requires a physical office and an extended set of approvals. The most costly solutions are those that combine business setup with residency, such as visas for family members, relocation services and ongoing support. Ultimately, the final price is determined by the overall cost structure — the licence itself, office space, visas and professional support.

|

Jurisdiction / Format |

Indicative Cost |

What’s Included |

Notes |

|---|---|---|---|

|

DMCC — Trading |

$11000–$14000 |

Licence, office, registration |

Requires a physical office and additional approvals |

|

IFZA — services |

$8 000–$11 000 |

Licence, registration, basic visa |

Flexible zone, suitable for consulting and IT |

|

RAKEZ — Small Business |

$12000–$16000 |

Licence, 2 visas, office |

Convenient for freelancers and small teams |

|

Relocation + Full Support |

$15000–$20000 |

Licence, visas, ongoing support |

Includes family visas and relocation assistance |

Good to know: IFZA is a free zone where you can start with a basic licence and add visas, an address and additional services as your business grows. This makes it ideal for a phased launch, as each step is paid for separately.

How Is the Cost of Company Registration Calculated?

The cost of setting up a company in the UAE depends on a wide range of factors. In some cases, the final amount can be two to three times higher than initial expectations. The key cost drivers include:

- Jurisdiction. For example, registration in Dubai is generally more expensive than in Ajman or Ras Al Khaimah.

- Company type. The more complex the corporate structure, the higher the registration costs: more shareholders mean higher notary fees, while a physical office increases rental expenses.

- Business activities and the number of licences . The more activities included, the higher the overall cost.

- Office format — virtual (from $300), physical (from $3,000), coworking (from $1,000).

- Number of residency visas. This affects both the package price and office space requirements.

- Additional costs. Notary fees, bank cards, permits and insurance, which may be mandatory depending on the case.

Example: Basic registration in a free zone may start from $2,000, but with multiple licences, a physical office and employee visas, the total cost can rise to $6,000–10,000 or more.

Employee-Related Costs

- Annual cost per employee: Medical insurance — from $800 to $1,500.

- Residency visa and Emirates ID — from $1,000 to $1,200, depending on the zone and staff category.

- Additional benefits (depending on the contract or role): airfare, accommodation and transport if included in the package; training and bonuses at the employer’s discretion.

- Legal considerations: employer-initiated terminations are regulated, employment contracts are often fixed for two years, and payroll planning is essential.

Licences

Licence fees in Dubai start from AED 8,000, but they can be twice as high depending on the free zone, the number of declared business activities, and certification requirements.

Factors that increase the cost

- Multiple business activities — each additional activity adds to the licence fee.

- Regulated sectors — if the business is related to medicine, education, construction or other regulated areas, additional certifications and permits are required.

- Qualification requirements — If the field of activity requires confirmation of qualifications, employees must be certified.

- Business plan approval or physical office — some zones mandate an approved business plan or a leased physical office before issuing the licence.

Key points to consider:

- Additional requirements not only raise costs but also extend the time needed to obtain the licence.

- In certain zones, hiring staff without attested qualifications is not permitted.

- The final cost depends on the chosen jurisdiction, the nature of your business, and the complete set of regulatory requirements.

Office Rental

- Physical office: Renting a physical office costs from $3,000 in Dubai and Abu Dhabi, and from $2,000 in other emirates. A physical office is essential if your business requires on-site staff, equipment storage, or client visits — for example, in healthcare, education, logistics, or manufacturing.

- Virtual office: Starting from $500 per month, this option suits companies in IT, consulting, marketing, and other online sectors. It typically includes a legal business address, mail handling, and access to meeting rooms if needed.

Requirements for the type of office vary by free zone. Some zones allow virtual offices, while others require a physical office to issue a licence. You can confirm the rules on the free zone’s official website or consult with our Dubai business setup specialists.

Additional Costs

Besides the licence, several other costs may apply*:

- Immigration card — $200: Required for registering the company with the UAE immigration authorities. Without it, you cannot issue visas.

- E-signature card — $500: An electronic signature is needed for online document submission and interaction with government authorities. Mandatory in some zones for shareholders.

- Additional permits — $500–3,000: Depending on the sector (healthcare, education, finance, logistics), additional approvals from relevant authorities may be required.

- Registration fee — $160: A one-time payment to enter the company into the official registry.

- Notary fees — $850: Covers document preparation and certification. Costs may be higher for companies with multiple partners or foreign shareholders.

- Residency visa for the founders — $2,000. This visa allows you to reside and conduct business in the UAE. Includes a medical examination and processing through immigration authorities.

Taxes for Companies in the UAE?

Companies registered in the UAE are subject to the following taxes:

Corporate Tax:

- 0% on profits up to AED 375,000.

- 9% on profits exceeding AED 375,000.

- Certain companies may be exempt if they operate in specialised sectors and/or are located in free zones. Eligibility and conditions for exemptions are listed by the Federal Tax Authority.

VAT (Value Added Tax):

- 5% applies to most goods and services.

- Local companies have to pay VAT if their annual turnover exceeds AED 375,000.

Excise Tax:

- Applies to goods deemed harmful to health.

- 50% on sugary drinks and sweetened products.

- 100% on tobacco products and vape accessories.

- Excise tax is levied on companies that manufacture, import, or store these products.

For most IT companies, online services, and consulting agencies registered in free zones, tax exemptions are available. By selecting the proper free zone and business activity, it is often possible to avoid corporate tax and VAT entirely.

Ready-Made Companies in the UAE: Is It Worth Buying?

Entering the UAE market quickly is possible by purchasing an existing company. However, this approach has its advantages and disadvantages.

|

Pros |

Cons |

|---|---|

|

– Avoids common registration issues, such as document problems or government rejections. – Ability to generate revenue immediately after purchase. – Established client and partner base. – Saves time on hiring staff. – Reduces marketing and promotion costs for a new brand. |

– Risk of buying a company on the verge of failure, with debts or unresolved issues from previous owners. – Due diligence is required, which may delay the launch of the business. – Additional costs for auditors and financial checks. |

Whether you decide to buy a ready-made company or register a new one from scratch is up to you. Our Dubai business setup consultants can help with any option, from acquiring an existing firm to complete company registration.

How to Obtain a UAE Residency Visa Through Company Formation?

Obtaining a residency visa is a mandatory step for anyone planning to set up a company in Dubai or any other emirate in the UAE. Residency offers numerous benefits similar to those available to UAE nationals.

What does a resident visa offer?

- Legal right to live and work in the UAE.

- Access to local banking, healthcare and government services.

- Eligibility to sponsor family members for visas.

- Opportunities for business expansion and employment of staff.

How to Obtain UAE Residency — Step by Step

- Choose a jurisdiction. Register your company in either a Free Zone or on the Mainland. The choice affects the type of licence, business activities, and visa options.

- Obtain an entry permit. For applicants outside the UAE, an Entry Permit is issued. That allows you to enter the country and start the residency process.

Prepare the corporate packageYou will need:

- Company Certificate of Incorporation Business licence

- Company immigration card

- Proof of deposited share capital (bank or financial institution letter)

Collect personal documents. Required documents include:

- Passport (notarised copy)

- Passport-size photo (3×4 cm) on a white background

- Medical insurance

- Medical fitness certificate from an accredited clinic

- Apply for an Emirates ID and a residency visa. Once all documents are submitted and approved, you will receive your Emirates ID and a multi-entry residency visa, valid for 2–3 years with the option to renew.

Key Investment Sectors in the UAE

Before setting up a company in Dubai or another emirate, it’s helpful to know which sectors are in high demand. The UAE offers strong opportunities in the following areas:

- Information Technology: Software development, cybersecurity, cloud solutions, AI services.

- Real Estate: Construction, property management, investments in residential and commercial projects.

- Manufacturing: Light industry, packaging, processing, production of export-oriented goods.

- Construction: Infrastructure projects, engineering, architecture, and facility management.

- Healthcare: Clinics, laboratories, telemedicine, pharmaceuticals.

- Services: Tourism, restaurants, consulting, education, and event management.

- Trade: Wholesale and retail, including e-commerce, import/export.

- Logistics: Warehousing, transportation, supply chain management, maritime and air freight.

The UAE government actively supports foreign investors, particularly those developing technology and businesses that reduce dependency on natural resources — a key pillar of the country’s economic strategy.

If you need advice on company registration in the UAE, the specialists at Dynasty Business Adviser can provide comprehensive guidance. Get in touch via any of the contact methods listed, and our Dubai business setup consultants will guide you through the process of opening a company in the UAE quickly and effortlessly.

Request a Consultation

Manager

Consultant

Lawyer

Manager

Manager (PRO)

Manager