Advantages of registering a company in Dubai

When compared to Abu Dhabi, Sharjah, Ajman, and other emirates, Dubai offers a more open and flexible environment for foreign investors than its neighbours.

The main advantages of choosing the emirate:

- A variety of jurisdictions and registration formats. It is possible to choose a jurisdiction for a specific business model: trade, IT services, consulting, investment, or holding structures. In other emirates, the choice of zones and licences is more limited.

- Strong banking and business ecosystem. Most international and local banks, auditors, legal, and corporate providers are located here. This simplifies opening accounts and further servicing the business.

- Flexible registration conditions. In DMCC, IFZA, or Meydan, it is easy to adapt the licence to the development of the company: adding types of activities or changing the structure will not be difficult.

- Access to the local market through the Mainland.Dubai Mainland allows you to freely work with clients within the UAE, enter into contracts with government agencies, and scale your business without territorial restrictions. In other emirates, this is difficult.

- Reputational advantage. A company registered in Dubai is perceived by international partners and banks as a more reliable solution compared to registration in other emirates.

Dubai is a convenient choice as a base jurisdiction for entering the UAE market and building an international structure. Even if the business will subsequently be present in other emirates.

Which Dubai jurisdiction to choose?

Dubai offers various formats for company registration, ranging from entering the domestic market through Mainland to specialised free zones. Each platform has different requirements for licences, offices and visas, as well as different levels of costs and reputation. Therefore, the choice of jurisdiction depends on what is more important for the business: working with clients within the UAE, minimising costs, or emphasising international status.

Below is an overview of the main zones that entrepreneurs most often choose to register a company in Dubai.

Dubai Mainland (DED Dubai)

Registering a local company is a choice for businesses focused on the Dubai and the Emirates market. Registration takes place through the Department of Economy and Tourism (DED) with the acquisition of local legal entity status. Commercial, professional, and industrial licences are available in the Mainland. Unlike free zones, the company’s activities are not limited to the territory of one zone. The key condition is the presence of an office in Dubai. Its address is recorded in the licence, and the area affects the visa quota. The larger the office, the more visas can be issued for employees. For every 9–10 m², one visa per employee is usually allowed. Local companies in Dubai are chosen by enterprises in the fields of trade, services, consulting, agency activities, as well as businesses focused on local customers, corporate contracts, and projects with state participation.

DMCC (Dubai Multi Commodities Centre)

Registration with the DMCC is considered one of the most prestigious in Dubai. The zone is focused on international business and attracts companies with its reputation as a reliable jurisdiction and access to global markets. The area is particularly suitable for trading in precious metals, jewellery and petroleum products. Registration requires an office or flexi-desk, as well as annual audited financial statements. The cost of a licence is above average, but justified by its status and access to developed infrastructure. DMCC is chosen by entrepreneurs who value international image, reliability and the opportunity to work with global partners.

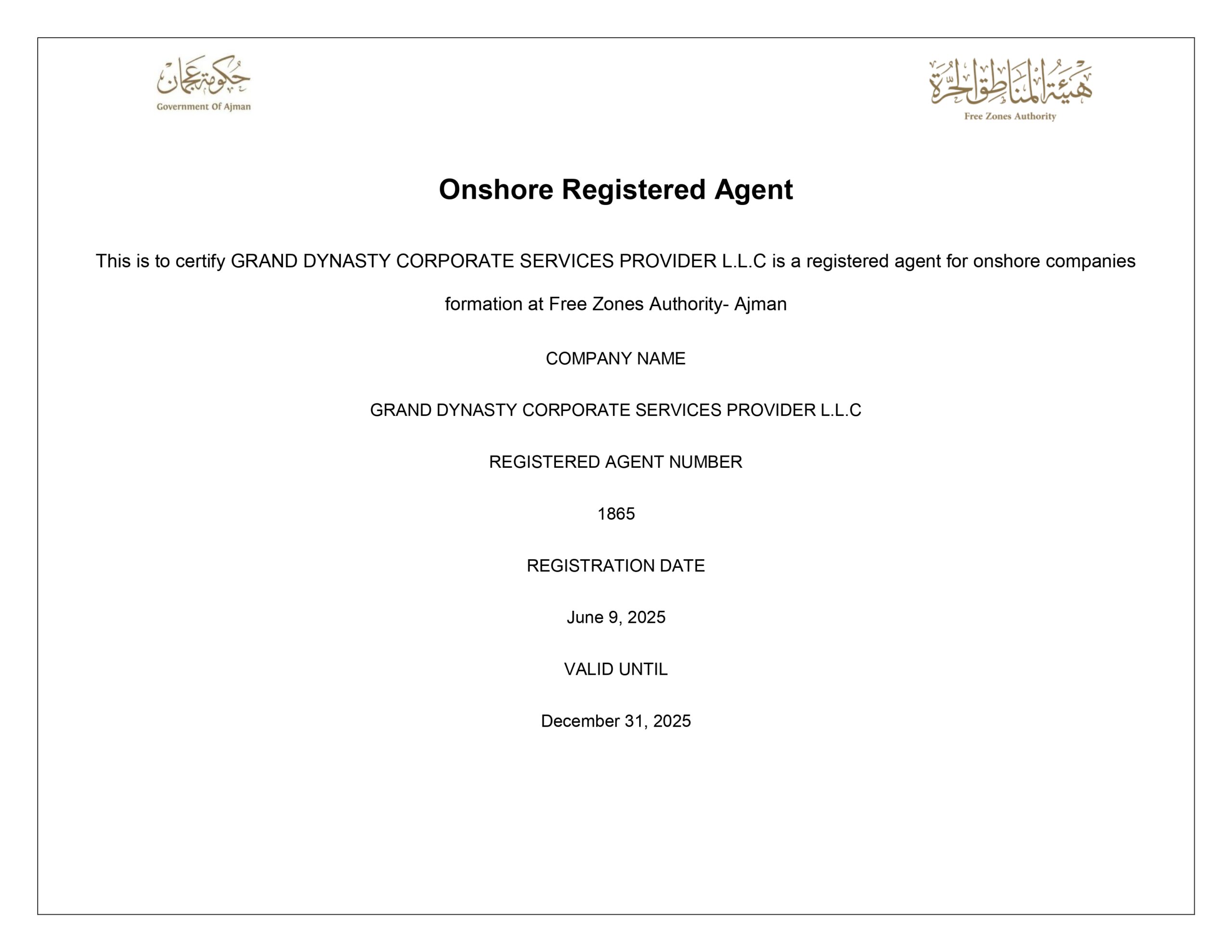

IFZA (International Free Zone Authority)

IFZA is one of the most flexible and accessible zones in Dubai. Registration here is quick: licences are tailored to specific business tasks, and office requirements are minimal — it is possible to work with a virtual address or flexi-desk. Licence options cover trade, consulting, IT, marketing, and online services. The zone offers convenient conditions for scaling: you can add new activities or change the structure of the company without complicated procedures. At the same time, IFZA maintains an international image and provides access to banking services and visa quotas. The cost of packages is lower than the average for Dubai, so the area attracts start-ups that want to test the market without large investments. IFZA is chosen by entrepreneurs who value low costs, flexibility and quick start-up, but at the same time want to maintain their registration status in Dubai.

Dubai South

Dubai South is a jurisdiction that has grown up around Al Maktoum Airport and Expo City Dubai. It was conceived as a logistics cluster, so it mainly houses warehouses, transport services and international delivery services. Local licences cover trade, logistics, e-commerce and aviation. Therefore, companies working in international trade, storage and distribution of goods, aviation and transport projects, and export-import operations are registered in the zone. There are various options available for registering an address, from flexi-desks to offices and warehouses. The location is specified in the licence, but visa quotas depend on the type of premises and activity. Flexi-desks usually come with up to two visas, while small offices come with three to six visas. When renting warehouse space, the quota can reach 15–20 visas or more.

Meydan Free Zone

Meydan Free Zone is a compact free zone in Dubai for service and international companies that do not need to operate in the local market. The jurisdiction is used to register companies that operate outside the UAE or work online. Dubai is considered the legal and administrative base. Meydan registers companies with licences for consulting, IT services, digital projects, international trade without warehouse logistics, as well as holding and investment structures. The format of the zone is designed for intangible services and cross-border transactions. Businesses involved in local trade and physical goods circulation usually choose other jurisdictions in Dubai. A physical office is not required: registration is available even on a flexi-desk basis. The address of the free zone is recorded in the licence and used for corporate and migration procedures.Basic requirements for opening a company in Dubai

Company registration in this region is designed for businesses that actually work with banks, partners and foreign markets. Therefore, attention is paid not only to documents, but also to how the company will operate in practice. This is the main difference from the Emirates, where the process often boils down to formal registration.

What is important to consider in comparison with other emirates:

- Business verification by banks. Banks look at the company’s structure, sources of income, countries of operation, and movement of funds. They assess the extent to which the declared activities coincide with how the company plans to earn money and conduct operations.

- The connection between the licence and actual activities. The types of activities in the licence must correspond to the actual operations. When the licence is selected correctly, further banking services and support are much easier.

- Requirements for the address and format of presence. Not only is the address itself important, but also its business level: the area, type of office, and suitability for the scale of the company. Addresses in developed business areas are perceived by banks as working rather than formal.

- Free zones with a recognisable reputation. DMCC, Dubai South and Jebel Ali Free Zone require a larger budget at the start compared to free zones in other emirates. At the same time, such zones are more easily accepted by banks and foreign counterparties.

- A visa model tied to the company’s activities The number of visas depends on the business format and level of presence. This approach allows you to build a stable structure and avoid questions during inspections.

Dubai is usually chosen not for its minimal requirements, but for its reputation, banking confidence and predictable business environment. The region is mainly suitable for companies focused on international markets and long-term presence in the UAE.

What taxes does a company have to pay in Dubai?

General tax rules apply in Dubai, but free zones allow companies to enjoy certain benefits.

Main taxes:

- Corporate tax is 9% of profits. In free zones, certain types of income may be exempt from taxation, subject to certain conditions.

- VAT is set at 5%. It becomes payable when a company’s annual turnover exceeds 375,000 dirhams.

- There are no personal income taxes. This also applies to income for individuals.

In addition to corporate tax and VAT, companies pay excise duties, customs duties, municipal fees and licence fees. Fees depend on the type of activity, the nature of goods and services, and the chosen jurisdiction.

Practical figures:

- In Dubai’s free zones (DMCC, IFZA, DIFC, ADGM), corporate tax can be 0%. In other cases, a rate of 9% applies. VAT remains at 5%.

- For mainland registration, corporate tax is levied at a rate of 9% on all company profits. VAT is also 5%.

The tax burden in Dubai depends on the chosen jurisdiction and the nature of the income. If the right location is chosen, the company saves money and gains access to international markets.

How much does it cost to open a company in Dubai?

In Dubai, you can open both a local company and a business in free zones. The price of registering a company in Dubai depends on the chosen jurisdiction, type of activity, business structure, and legal presence requirements. The basic cost of registration in the IFZA и Meydan Free Zone без визовых квот составляет от 12 900 AED. Регистрация фирм со сложной структурой в DMCC and JAFZA without visa quotas is from AED 12,900.

Opening a company in Dubai, price — depending on jurisdiction — in the table:

| Jurisdiction | Company format | Budget guideline | Terms and conditions |

|---|---|---|---|

| IFZA | Basic free zone without visas | from ~12,900 AED | Minimum start-up, no physical office or visa quotas |

| Meydan Free Zone | Free zone without visas | from ~12,125 AED | Minimal start-up, no physical office, visa quotas or establishment card required |

| DMCC | Free zone with office | from ~32,000 AED | Higher requirements, positive reputation |

| JAFZA | Free zone with office | from ~32 000 AED | Trade, logistics, infrastructure |

| Dubai Mainland | Local company | Individually | To apply for a visa, you must have an office, be registered with the labour department and obtain an establishment card |

The exact cost is always calculated individually. It is influenced by the type of activity, the number of founders, the need for resident visas, the office format, and bank requirements.

Get a quoteWhat does the cost of registering a company in Dubai consist of?

The final budget is formed from several mandatory and variable items of expenditure:

- Licence — depends on the jurisdiction and type of activity.

- Registration fees — set by the regulator of a specific zone or mainland.

- Office or flexi-desk — a mandatory element for a number of jurisdictions in Dubai.

- Visa quotas — depend on the number of founders and employees.

- Banking support — preparation for opening an account and compliance.

- Accounting and reporting — mandatory after registration, especially for VAT and Corporate Tax.

Why is the cost of registration always calculated individually?

Even within the same jurisdiction of Dubai, the budget may vary. The final amount is influenced by:

- the type of activity chosen;

- the number of founders;

- the need for resident visas;

- office requirements;

- bank expectations regarding the structure of the business.

Therefore, an accurate calculation is only possible after consultation, when we take into account all the parameters of your project.

How to open a company in Dubai: step-by-step instructions

You can open an LLC in Dubai both in a free zone and on the mainland. The outcome of your business development directly depends on the jurisdiction you choose. The same business project, when registered through Dubai DED, DMCC or IFZA, goes through different stages, faces different levels of scrutiny and requires different documentation. The key steps are described below, taking these differences into account.

- Choosing a jurisdiction

- Choosing the type of activity and licence

- Choosing and designing the office format

- Company registration and licence issuance

- Opening a corporate bank account in Dubai

- Additional steps if necessary

Step 1. Choosing a jurisdiction

At this stage, the logic of the entire structure is laid down: where the business will operate, what requirements will arise from the regulator, and how the project will look to banks. The choice of jurisdiction is determined by the business objectives and the planned operating model.

- Dubai DED — a format for working with the local market and contracts within the country. Requires a physical office. We can help with this thanks to our partnership programmes with business centres. A local LLC is suitable for trade, services, agency and consulting projects with local clients.

- DMCC is the choice for international operations, trade, holding companies, and structures with increased expectations from banks. It is characterised by stricter compliance, requirements for economic presence, and the quality of the corporate structure.

- IFZA is an option for service and project companies where speed of launch and a simple management model are important. It is suitable for projects without commercial activity in the domestic market and for offshore structures.

A mistake at the first step leads to licence replacement or problems with banks. Therefore, the choice of jurisdiction is always made before submitting documents, not during the registration process.

Step 2. Choosing the type of activity and licence

At this stage, the legally permissible scope of operations and the framework of the company’s work are determined. The type of activity affects the list of permitted transactions, the assessment of the project by banks and the need for additional regulatory approvals.

- Dubai DED (Mainland) — the business direction is chosen exclusively from the official classifier. The licence must fully correspond to actual operations: trade, intermediation, services, consulting. For certain areas, confirmation of experience, specialised education or approval from supervisory authorities is required.

- DMCC — the regulator evaluates the company based on its economic essence. The type of activity is compared with sources of income, types of counterparties, and expected transactions. Discrepancies between the licence and the actual business model often lead to delays in opening a bank account.

- IFZA — allows for more versatile solutions for service and international projects. However, the selected profile must cover all operations, otherwise the bank may require its expansion after registration.

Mistakes at this stage lead to operational restrictions, questions from banks, or the need to change the licence after starting the business. Therefore, it is better to do it with the participation of specialists.

Step 3. Choosing and designing the office format

At this stage, you determine which office format is acceptable for the chosen jurisdiction and licence. This decision is made before submitting the documents, as it determines the registration conditions, visa quotas and regulatory requirements.

Several formats are used in Dubai:

- legal address in a free economic zone — used for basic structures without physical presence;

- workspace in a coworking space — the minimum format that may be required for a licence or visas;

- separate office — mandatory for local companies and certain free economic zones.

You can open an office in Dubai either before or during the registration process, depending on the jurisdiction. The main thing is that its format matches the business model.

Step 4. Company registration and licence issuance

At this stage, the company obtains legal status. However, each platform in Dubai offers its own registration procedure and set of conditions. Therefore, the procedure varies depending on where you open your business.

- Dubai DED provides a mainland licence. It gives you the right to operate directly in the local UAE market. This format requires renting an office and strict compliance with regulatory requirements. The key advantage of the zone is the ability to enter into contracts with government agencies and trade within the country without restrictions.

- DMCC (Dubai Multi Commodities Centre). One of the most prestigious free zones, especially for trading in raw materials, precious metals and stones. A DMCC licence is valued for its international image and reputation: many banks and partners are eager to work with companies registered in this zone. The registration procedure includes verification of the business model and compliance with transparency standards.

- IFZA. A more flexible and accessible free zone focused on small and medium-sized businesses. It features simple registration packages, minimal office requirements, and a wide range of services — from consulting and IT to marketing and e-commerce. IFZA allows you to quickly obtain a licence and conduct international projects without a physical presence.

After the licence is issued, the company details are entered into the register of the chosen jurisdiction. Any changes after this stage require separate approval and additional costs.

Step 5. Opening a corporate bank account in Dubai

After the licence is issued, a corporate bank account is opened. At this stage, the bank assesses the company’s structure and business model in terms of financial logic and regulatory requirements. The focus of the review is on sources of income, geography of operations, counterparties and the role of the founders.

- Dubai Mainland (DED). Banks expect real operating activities in the UAE. They check whether there are local contracts, whether the office meets the requirements, and what sources generate cash flow within the country.

- DMCC. An area with a high level of trust, but also with more detailed checks. The bank finds out what the structure of the group is, who the international counterparties are, what goods or services underlie the operations, how the trading logic is structured, which countries are involved in settlements and deliveries, and to what extent the model meets compliance requirements across jurisdictions.

- IFZA. Suitable for international and service projects without local operations. Banks look primarily at the transparency of the structure to see the real beneficiaries and assess the legality of the funds received.

The same business may pass verification at one bank and receive additional questions at another. Therefore, it is important to consider not only the licence but also the practices of specific institutions. We select a bank for a specific jurisdiction, licence, and business model. This reduces the risk of refusals and delays.

Additional steps if necessary

After registering a company in Dubai, additional steps may be required, depending on how you plan to conduct your business. These steps are not mandatory for everyone and are taken as needed.

These include:

- processing resident visas for founders and employees;

- accounting support;

- tax registration — when relevant obligations arise.

All these steps depend on the company’s line of business, the need for a team of employees to be present in the UAE, and actual operations.

How we help you start a business in Dubai?

The decision to start a company in Dubai often seems simple, but in practice, clients are faced with returning documents, licences that do not meet banking requirements, and the need to rework the structure after registration. We know how to open a company in Dubai so that it is immediately ready to operate, meets regulatory requirements, and does not create problems in subsequent stages.

We select the registration format, register the company and accompany the process until the business is launched. We take care of:

- selection of the registration format and jurisdiction — mainland or free economic zones;

- opening a company in Dubai free zones, including DMCC, IFZA, JAFZA and other zones;

- business administration and PRO support during and after registration;

- opening a corporate bank account in UAE banks;

- accounting support;

- support during business scaling — registration of branches, change of corporate structure, and obtaining additional licences.

We pay special attention to:

- supporting registration in areas with increased requirements for economic presence;

- selection of an office format that meets the requirements of a specific jurisdiction and future visa tasks;

- preparation of corporate documents taking into account regulatory requirements;

- accounting and tax support for the business after launch.

The region offers quick solutions, but only for those who understand the rules of the game. It is important not just to register a company, but to immediately establish a working structure that will pass the banking stage, be scalable, and not require reworking after a few months. Dynasty Business Advisor helps you register a company in Dubai so that your business is ready for operations from day one.

Start with a consultation and receive a clear launch plan tailored to your goals today. Along with it, you will have the opportunity to enter Dubai’s elite business circle and immediately experience the advantages of a global business centre.